Wednesday, 4/10/24:

H521 was signed into law just over a week ago.

Monday, 3/25/24:

H521 passed the Senate last week and awaits the governor’s signature.

Saturday, 2/24/24:

H521 represents a major part of Gov. Brad Little’s agenda this year. It’s a complex bill, straining the definition of “single subject”. From the statement of purpose:

This legislation provides the largest state investment in school facilities through three main avenues. First,

it dedicates $125 million in ongoing sales tax revenue to the new School Modernization Facilities Fund for

bonding, while providing the legislature with expanded options to cover annual service on the bonds in the

event of economic downturns.Second, this legislation increases the funding to the School District Facility Fund in two ways. It increases the

sales tax revenue directed to the fund from 2.25% to 3.25% which is projected to be $25 million in FY 2025,

and redirects existing lottery dividends to the fund, which is projected to be approximately $50 million in FYThis fund will help school districts with paying down school bonds, levies, and plant facility levies, with

any remaining funds being used at the district level for additional school facility projects.

Third, this legislation reduces income taxes from 5.8% to 5.695%, allowing Idahoans to have more money to

better support local bonds and levies related to school facilities.

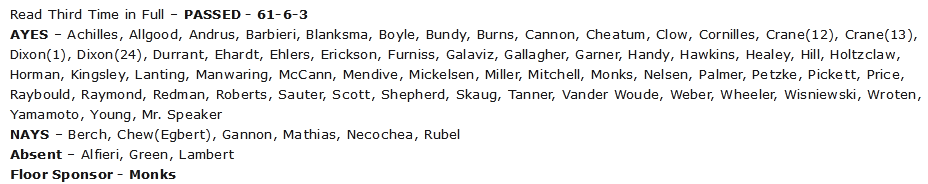

H521 was reported out of House Revenue & Tax on 2/20/24 with a do pass recommendation and quickly reached the House floor, passing 61-6-3 yesterday. Some Democrats argued against the tax cut provision as well potential inequity in distribution of state funds to various school districts. It heads to the Senate.

About Brian Almon

Brian Almon is the Editor of the Gem State Chronicle. He also serves as Chairman of the District 14 Republican Party and is a trustee of the Eagle Public Library Board. He lives with his wife and five children in Eagle.