Tuesday, 3/12/24:

Update: Rep. Stephanie Mickelsen’s motion to hold H447 indefinitely passed 10-7 after an amended substitute motion by Rep. Jeff Ehlers to send to the floor with no recommendation failed 8-9. The bill is dead.

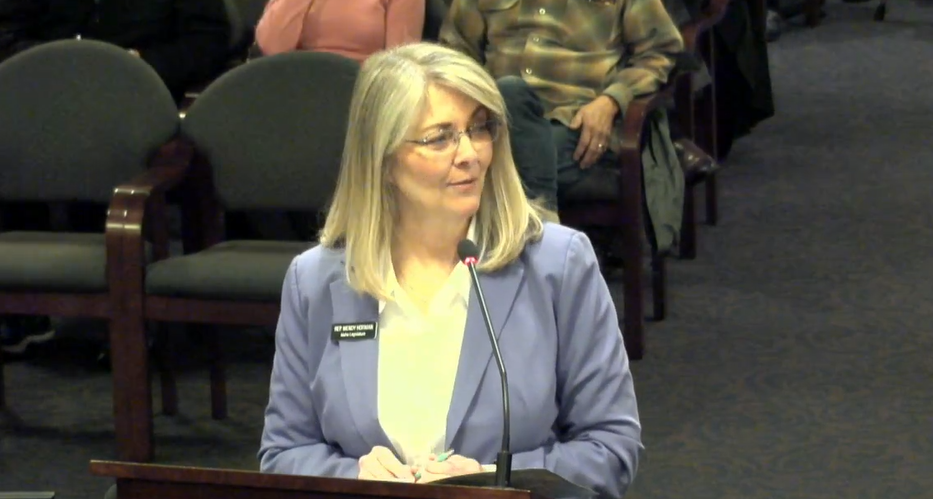

Rep. Wendy Horman finally presented H447 to the House Revenue & Taxation Committee this morning. It’s been so long that the committee has been rearranged, with former chair Rep. Jason Monks taking over as House Majority Leader and vice chair Rep. David Cannon taking over as chair.

Read my live thread here.

Tuesday, 1/30/24:

Sen. Lori Den Hartog has finally introduced the long-awaited school choice tax credit bill. She presented the RS in the House Revenue & Taxation Committee this morning on behalf of cosponsors Reps. Wendy Horman and Jason Monks and Sens. C. Scott Grow and Doug Ricks.

The bill would allow qualified families to claim a refundable tax credit of up to $5,000 to offset education expenses, or $7,500 for children with special needs. The expenses can be occurred paying for private school, microschools, etc. It does not appear to apply to homeschoolers.

The bill is capped at $40 million, with credits being given out first come, first serve. That means that the program will be limited to a maximum of 8,000 children, less if they are special needs.

Rep. Stephanie Mickelsen moved to introduce the bill, but Rep. Rick Cheatum asked for a roll call vote. Rep. Kenny Wroten asked to enforce House Rule 80, which relates to disclosure of potential conflicts of interest. Wroten seemed concerned that members of the committee with children in private schools should be required to disclose that fact, but Chairman Jason Monks reminded him that Rule 80 disclosures are voluntary on the part of the representative. Monks also pointed out that since this would take effect next year, every parent with school aged children is in the same boat of being able to potentially take advantage of the credit.

Rep. Wroten asked if there was a new revenue source for the $40 million. Sen. Den Hartog replied that as a tax credit it comes out of existing tax revenues, or out of the general fund which is made up of sales and income taxes.

Rep. Ned Burns asked if there were any other tax credits that were first come, first served, and Sen. Den Hartog replied that she was not aware of any.

The committee voted by roll call 13-3 to print the bill, with Democrat Rep. Lauren Necochea joining Republican Reps. Kenny Wroten and Rick Cheatum in voting no. The bill was printed shortly thereafter as House Bill 447.

About Brian Almon

Brian Almon is the Editor of the Gem State Chronicle. He also serves as Chairman of the District 14 Republican Party and is a trustee of the Eagle Public Library Board. He lives with his wife and five children in Eagle.