Last week, Rep. Wendy Horman presented the latest version of the school choice tax credit bill. House Bill 93 is a tax credit of up to $5,000 that would be available to families whose children attend non-public schools. Watch Horman present the RS in the House Revenue & Taxation Committee last Thursday:

This bill is the product of many months of collaboration between legislative leaders and the governor’s office. JFAC co-chairs Rep. Wendy Horman and Sen. C. Scott Grow are listed as co-sponsors along with House Majority Leader Rep. Jason Monks and Senate Majority Leader Sen. Lori Den Hartog. These four also worked closely with Gov. Brad Little, who for the first time indicated his support for a school choice program when he promised $50 million in his State of the State Address last month.

$50 million is indeed the cap in this bill, meaning that it’s possible not all families who wish to claim the tax credit will be able to do so. The credit will be awarded on a first-come, first-serve basis, with priority going to families who make under 300% of the federal poverty line.

Gov. Little called for “accountability” in any school choice program, which set off alarm bells for conservatives. As. Rep. Monks said in the House Republican response to the State of the State, true accountability comes from parents, not from imposing the same system that is failing students in public schools on private and homeschooling families.

When Rep. Horman mentioned “accreditation” in her presentation Thursday morning, those alarm bells grew louder. However, after carefully reading the text of the bill I think I can put most of those fears to rest.

On the second day of the session, I laid out my criteria for whether or not I could support a school choice bill:

While this is not as much as school choice proponents such as myself want to see — the state spends an average of $8,500 per student in public school districts, so I believe discussions should start there — it is doable. There are some issues, such as the fact that poor families likely couldn’t afford the initial expense before receiving a tax credit the following year, however once the program is in place we can gauge interest and increase both the credit and the overall cap from there. If school choice proves popular, then there will be additional pressure on the Legislature to make the program available to more families.

I went on to explain that any accountability requirements, such as teacher certification, oversight of curricula, or standardized testing would make the bill a non-starter. You see, we can always change the numbers later. If $5,000 per student is not enough for most families, the Legislature can increase it. If $50 million isn’t enough to cover everyone who wants to participate, the Legislature can increase that too. But once stringent reporting requirements are embedded in the law, it will become more difficult to remove them should they prove too onerous.

After carefully reading the text of House Bill 93, I believe I can support this, and I think you should too.

The “accreditation” that Rep. Horman mentioned in her presentation is for any private school that enrolls students who are claiming the tax credit. However, accreditation is not defined in the bill, and nearly all private schools are accredited by some agency. Some even accredit themselves, which would fulfill the requirements of H93.

Obviously there is a danger that the Legislature could someday restrict accreditation to only certain agencies, but there’s really no way to prevent that. Even if H93 did not have an accreditation requirement, the Legislature could always add one in the future anyway.

The other options — microschools, pod schools, etc. — simply require a portfolio documenting what students worked on throughout the year. There is no requirement that this portfolio be shared with the government, or with anyone for that matter. It would potentially need to be available should you be audited by the Tax Commission, but that’s it.

Notice homeschooling is not mentioned in the text of the bill. According to people I talked to who were involved with its drafting, homeschooling families would be able to claim the tax credit to reimburse them for curricula and other materials. They would just need to keep their receipts.

This might not placate the vocal homeschooling activists who have been opposing school choice for years, but at this point I doubt anything will. However, I’ve always maintained that no school choice legislation could possibly “open the door” to future regulation of homeschooling, because the Legislature could regulate homeschooling at any time, no matter what happened in the past.

In any case, Rep. Dale Hawkins recently introduced a potential constitutional amendment that would clarify once and for all that parents, not the government, are the primary custodians of their children’s education. Passing that amendment will hopefully put homeschool families at ease for good.

H93 also requires all parents claiming the tax credit to fill out a survey created by the Legislative Services Office regarding their satisfaction with the program. The results of this survey will be made available to the governor and the Legislature each year. While I’m sure some will be concerned with privacy, I believe this is a positive thing. Between the survey results and an annual report that includes how many parents applied for the credit but did not get it, the Legislature will surely be pressured to increase the credit and the cap in future years.

Former senator Scott Herndon has come out against school choice tax credits recently, pointing out that this is $50 million in new spending, essentially a new government program, and that the refundable tax credit means some families will receive more than they actually paid in taxes. This is by definition redistributive, but where I depart from Herndon on this issue is that I don’t think that’s a deal-breaker. The government is already constitutionally required to fund public schools, and allowing parents to take up to $5,000 to an alternative non-public option will likely yield superior results to the existing public system.

Right now, families who send their children to public schools are benefiting from an average of $8,500, paid by Idaho taxpayers, and more on the federal side. Many families owe less than that amount in taxes, which means we are already redistributing tax dollars, so why not do it better by giving parents the choice?

Another objection from conservatives is that this bill does not reduce funding for public schools. That’s true — the $50 million does not come out of the education budget. Yet the governor has made it clear that he absolutely opposes any reduction in public school funding. While we might wish it were otherwise, we have to play with the hand we’ve been dealt. We shouldn’t let the perfect be the enemy of the good.

Besides, a tax credit is not quite the same thing as an appropriation. This $50 million will be returned to Idaho taxpayers, which is more along the lines of a tax cut than new government spending. That’s $50 million per year that the governor and the Legislature will not be able to invest in other programs.

It’s imperative that we provide an off-ramp from the public school system for families who want to try other options, but are currently unable to do so due to costs. As these families leave, public schools will have to improve in order to compete with the free market rather than simply demanding the Legislature increase funding every year. That funding will eventually decrease the more that families exit the system.

One other objection I’ve heard is that a tax credit is retroactive, which means low-income families might not be able to pay for private school tuition up front. However, this bill provides for an advance payment, essentially an early tax refund, should they be approved. Once in the system, families who wish to claim the credit again receive top priority, so they can be sure they won’t miss out after investing time, energy, and money in switching to an alternative system only to be denied in the future.

We all know that school choice is inevitable. Idaho is lagging behind other red states in allowing some money to follow the child, and Republicans in the Legislature are feeling the pressure. Sen. Dave Lent, a longtime opponent of school choice, introduced a bill today that expands the Empowering Parents Grant, perhaps hoping to steal thunder from Rep. Horman by getting it to the governor’s desk first. Lent’s bill includes a lot more accountability and reporting than Horman’s, expanding the public system into the private sector rather than allowing parents to make their own choices. I’ve been watching testimony against S1025 while writing this article, and it is a preview of how public school defenders will oppose H93, despite it being a clear attempt to preempt real school choice.

After several hours of testimony and debate, the committee voted 5-4 to send S1025 to the floor with no recommendation. It’s going to be a race to see which bill reaches the governor’s desk this session.

The zeitgeist further changed last week when President Donald Trump issued an executive order to promote school choice nationwide. We now inhabit a vastly different landscape than the one in which Senate Bill 1038 failed 12-23 on the Senate floor in 2023. Now, any Republican voting against school choice risks looking incredibly extreme and out of step with the majority of Republican voters.

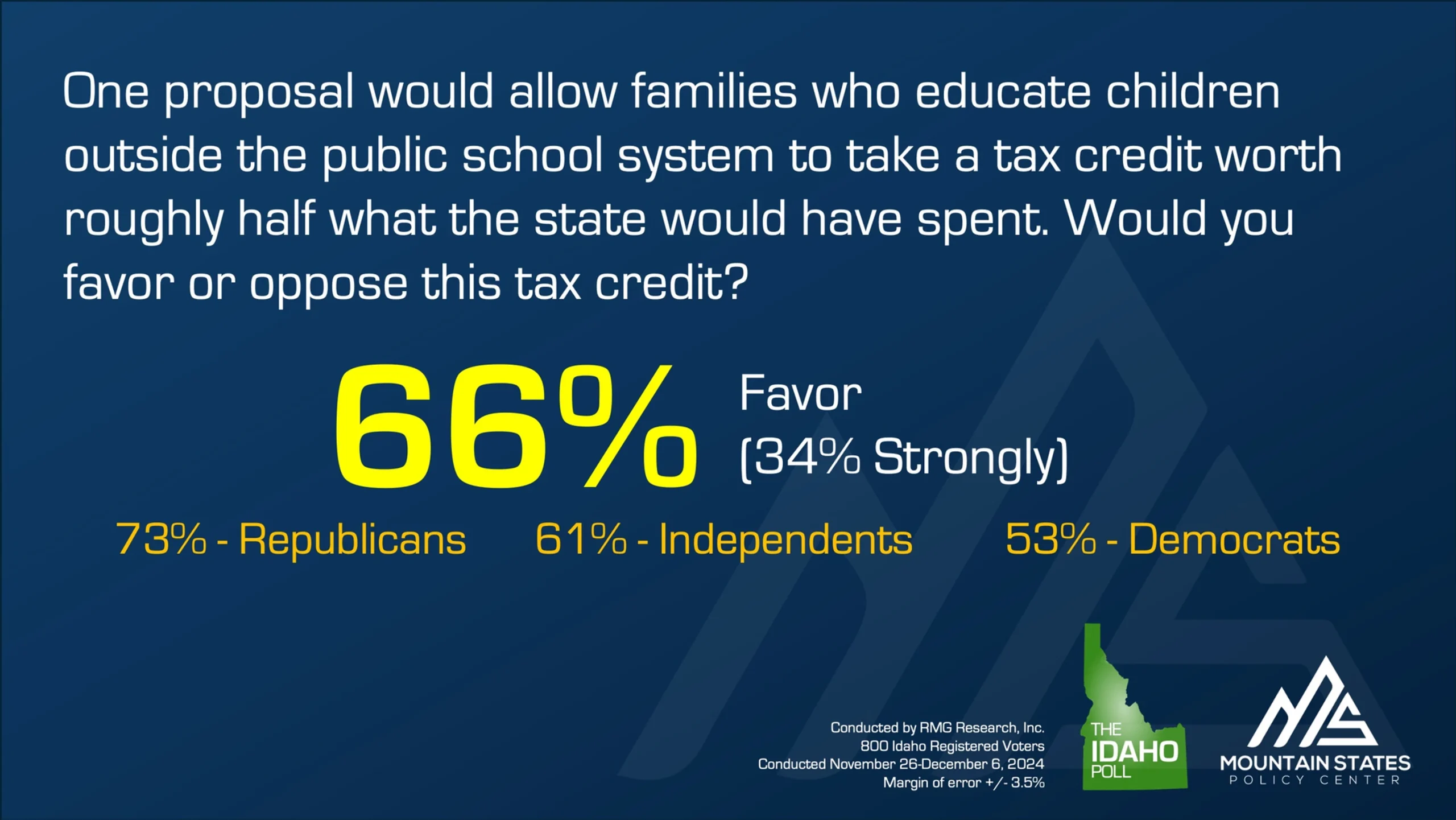

Even Democrat voters support some form of school choice. Late last year, Mountain States Policy Center asked respondents to its Idaho Poll about a potential $5,000 school choice tax credit. 73% of Republicans supported the idea, along with 53% of Democrats:

To summarize: House Bill 93 would provide up to $5,000 per student not enrolled in the public school. The credit would be capped at $50 million on a first-come, first-serve basis, with low-income families getting priority. If a participating family enrolls their children in a private school, it must be accredited by some agency or association, while other alternative programs simply require parents or teachers to maintain records of student work.

There are no requirements for teacher certification, standardized testing, or oversight of curricula. Parents remain in control of their children’s education, and parents will provide accountability for the program.

While I would like to see a bill that starts higher than $5,000 per student and a $50 million cap, such as Rep. Clint Hostetler’s personal bill H1, I think H93 is a good start. The proof in the pudding is in the eating, and if H93 becomes law Idahoans will have a chance to sample that pudding.

Gem State Chronicle is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

About Brian Almon

Brian Almon is the Editor of the Gem State Chronicle. He also serves as Chairman of the District 14 Republican Party and is a trustee of the Eagle Public Library Board. He lives with his wife and five children in Eagle.