LINK: House Bill 040

SPONSOR: Reps. Mike Moyle and David Cannon

IFF Analysis: +2

STATUS: Awaiting vote on House floor

STATEMENT OF PURPOSE:

This legislation reduces state government’s income tax burden, allowing Idahoans to keep more of their own hard-earned money. First, it reduces Idaho’s flat income tax rate on individuals and corporations from 5.695% to 5.3%. Second, it expands Idaho’s income tax exemption on U.S. military pension income to include certain disabled veterans under age 62, all veterans aged 62-64, and undisabled veterans under age 62 who are also employed and earn sufficient income to owe federal income taxes. And third, it removes capital gains and losses for both precious metal bullion and monetized bullion from the calculation of state income taxes.

LATEST NEWS:

1/30/25: Speaker Moyle presented H40 in House Rev & Tax Thursday morning. Rep. Berch against debated against the tax cut, but the committee voted to send it to the House floor.

1/23/25: Speaker Moyle introduced this bill in the House Revenue & Taxation Committee this morning. The committee voted to print the bill, with Democratic Rep. Steve Berch voting against the motion.

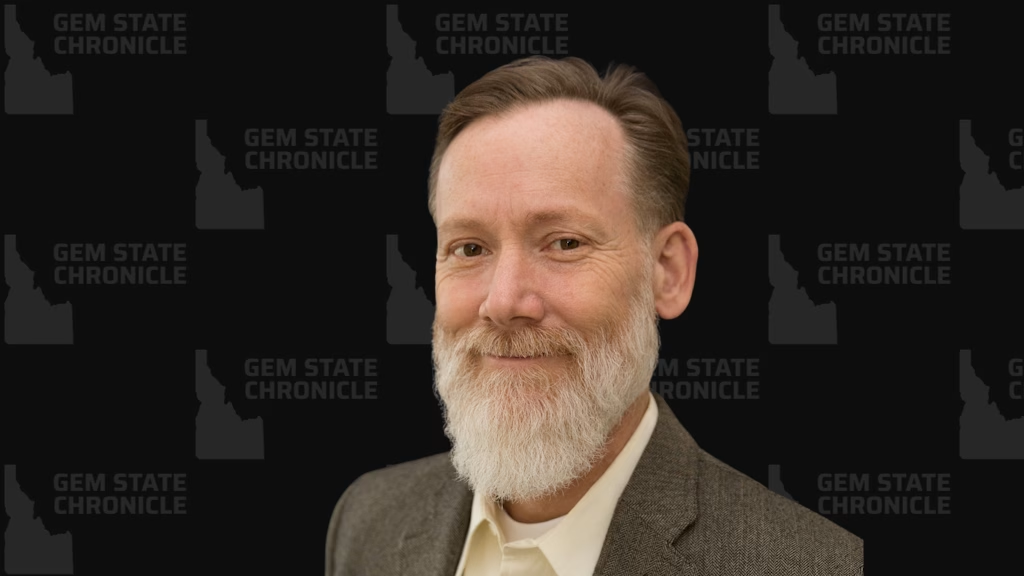

About Brian Almon

Brian Almon is the Editor of the Gem State Chronicle. He also serves as Chairman of the District 14 Republican Party and is a trustee of the Eagle Public Library Board. He lives with his wife and five children in Eagle.