Last year, the Idaho Legislature brought Idaho further into the 21st century with the passage of House Bill 93, the Parental Choice Tax Credit. As you’ll recall, this bill allows families with children in nonpublic schools to claim up to $5,000 in qualified expenses in the form of a tax credit, with priority given first to families under 300% of the federal poverty line, and first-come, first-served after that.

The filing period for the tax credit opened on January 15 and will close on March 15. According to the Mountain States Policy Center, more than 6,030 families representing 10,105 students have already applied for the credit, even though we are not yet halfway through the filing period. Depending on how much each family claims per student, it’s possible the $50 million cap has already been reached, with remaining applications sorted based on the poverty threshold.

I explain this to highlight how surprising it was to see Sen. Kevin Cook introduce a bill that would cut that $50 million cap by $2 million this year and another $2.5 million next year. Chris Cargill at Mountain States Policy Center posted a recap yesterday:

During committee debate, the bill’s sponsor, Senator Kevin Cook, openly acknowledged that the legislation “may hurt somebody.” Later, he said, “what a better time to take some back a little bit?”

Check out my discussion with Matt Edwards on Idaho Signal which includes clips of the print hearing:

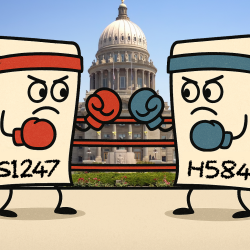

Senate Bill 1281 passed out of committee on a 6–3 vote, with Sens. Cook, Van Burtenshaw, Dave Lent, Carrie Semmelroth, Janie Ward-Engelking, and Jim Woodward supporting the motion. All six voted against H93 on the Senate floor last year. Meanwhile, three senators—Cindy Carlson, Tammy Nichols, and Christy Zito, each of whom voted for H93 last year—voted against printing S1281.

Perhaps the most telling moment of the presentation came when Sen. Nichols pointed out that the Senate Education Committee was not the appropriate venue for introducing a bill dealing with the tax code. As you may recall, H93 was specifically designed to avoid altering any statutes related to public education. It is a tax credit, not a change to the educational system.

Chairman Dave Lent’s defense of allowing the introduction was also telling. He is technically correct that non-germane bills can be introduced in his committee, but that raises the question: why? The answer seems straightforward. The Senate Local Government & Taxation Committee voted in favor of H93 last year, which means its members were unlikely to vote to introduce a bill undoing part of their own work before it has even gotten off the ground. The bill was referred to Local Government & Taxation this morning anyway, where it will be up to Chairman Doug Ricks whether it receives a hearing.

From watching morning hearings of the Joint Finance-Appropriations Committee (JFAC), I understand that Sen. Cook is frustrated with how the Legislature is handling budget reductions this year. He was particularly concerned with the $10 million that JFAC voted to rescind from the In-Demand Careers Fund—that is, the Launch Grant—and explicitly introduced this bill in response to that reduction.

I asked Sen. Cook for his thoughts on school choice and the Launch Grant in a conversation back in the spring of 2024. Here is a clip from that exchange:

During his presentation, Cook referred to the tax credit as a “voucher scheme,” language commonly used by Democrats and their allies in local print media. Yet it is not a voucher; it is a tax credit. On the other hand, Launch could reasonably be described as a voucher. Students and families are not directly reimbursed for tuition; rather, funds are sent from the state to the institution.

I would suggest that this is one of several major differences between the Parental Choice Tax Credit and the Idaho Launch Grant. The tax credit is not an appropriation—it never went before the Joint Finance-Appropriations Committee (JFAC). It is a tax credit, meaning it reduces the tax revenue collected by the state. For those on the left, that distinction makes little difference, because they begin from the premise that the state owns your income and may generously allow you to keep some of it after funding preferred programs. Conservatives, on the other hand, believe your income is yours, and that government may take a portion only to fulfill the basic functions of government.

Launch, by contrast, is an appropriation. JFAC must reappropriate the In-Demand Careers Fund each year. That requires the Legislature to move money from the General Fund to sustain the program, which is funded by taxpayers.

I’m not raising these points out of ill will toward Sen. Cook. I believe there is a genuine divide among Idaho Republicans in how they approach education policy. What matters more—parental and student autonomy, or government oversight to ensure standards are met? Will allowing families to choose the system that works for them, even if it is not regulated by the state, result in worse educational outcomes? A lot of people seem to think so.

That brings me to the last, and perhaps most important, difference between Launch and the tax credit: control. With the tax credit, parents are free to claim reimbursement for private school tuition, tutoring, microschools, or even curricula used for homeschooling. None of these options fall under the authority of the State Department of Education, and H93 did not impose educational standards beyond a basic foundation in English language arts, mathematics, science, and social studies.

Launch, on the other hand, is limited to careers the Workforce Development Council determines to be in demand. At present, that list includes fields such as commercial driving, welding, hospitality, dentistry, IT support, project management, bookkeeping, coding, HVAC, and automotive technology. It also includes cosmetology, barbering, and eyelash esthetics.

When the bill was introduced in 2023, my impression was that the definition of “in-demand career” depended in part on which industry leaders donated to which political figures, and I’ve not seen much to change my mind since.

There is another significant difference between JFAC’s vote to pull $10 million from Launch and Sen. Cook’s attempt to reduce the tax credit. In the case of Launch, Workforce Development Council Executive Director Wendy Secrist explained this week before JFAC that the fund is holding a substantial amount of money that had been awarded to prospective students who ultimately did not use it. Some changed their plans; others fell below eligibility thresholds. In either case, the unused funds were returned to the account, making them available for reduction.

By contrast, the Parental Choice Tax Credit filing period is still ongoing. No one has yet been formally notified that they will receive the credit this year. As I noted earlier, it is likely that not everyone who applies will receive a share of the $50 million cap. If Sen. Cook’s bill were to pass—unlikely as that may be—it would reduce the number of families able to claim the credit on this year’s tax return. It would literally be pulling the rug out from under Idaho families.

In full disclosure, I applied for the tax credit for my three children. It does not cover the full tuition at their school, but it would make a meaningful difference for our family’s budget. I am nevertheless saving taxpayer money overall, since it costs around $9,000 per child enrolled in the public school system.

Even if S1281 were to pass, I do not believe my family would be affected, since we applied early and fall below the 300% poverty threshold. Even so, I do not believe it is fair to scale back the program for other families who may be counting on it—especially before it has had a chance to operate.

More than three years ago, long before the idea of a tax credit gained traction, I wrote an article for the Idaho Freedom Foundation about the public school establishment’s opposition to school choice:

If Idaho adopts true school choice, as conservative states throughout the nation are doing right now, it will not come from Critchfield, Gov. Little, or anyone else in power. No, it will have to come from the grassroots, from ordinary families struggling in low-performing school districts or dealing with woke ideology being shoved down their students’ throats, who put pressure on their lawmakers to create a real and lasting change in the public education system.

That day finally came when the Legislature passed H93 and Gov. Little signed it into law. As always, the proof in the pudding is in the eating, but Sen. Cook wants to take some of that pudding away before anyone in Idaho has had a taste.I believe that S1281 is misguided, and I hope the Senate committee rejects it if it receives a hearing.

Feature image created with Microsoft Copilot.

Gem State Chronicle is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

About Brian Almon

Brian Almon is the Editor of the Gem State Chronicle. He also serves as Chairman of the District 14 Republican Party and is a trustee of the Eagle Public Library Board. He lives with his wife and five children in Eagle.