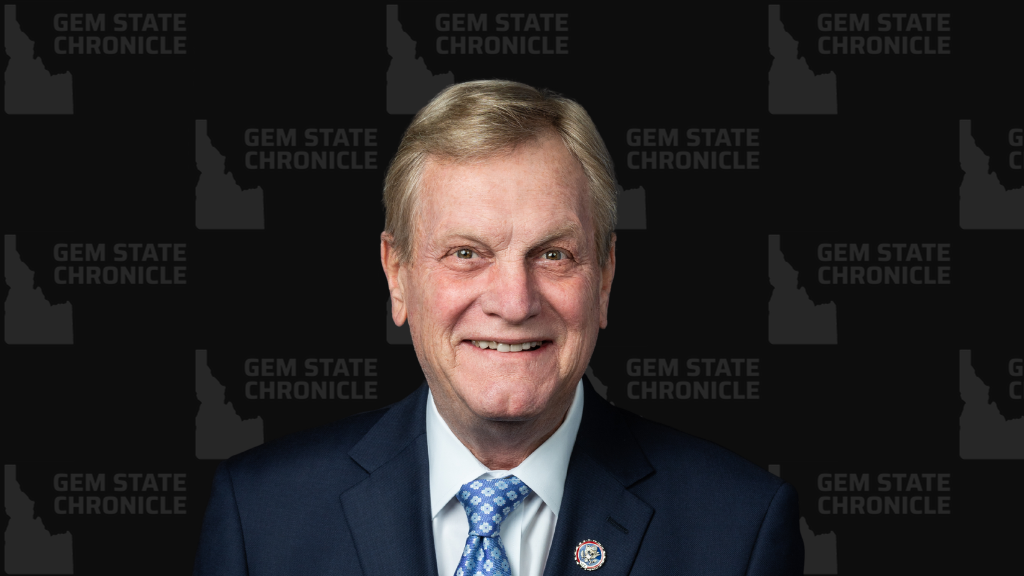

By Sen. Mike Crapo

A Note From Senator Crapo:

We have entered the second half of the 119th Congress. I will continue serving as Chairman of the U.S. Senate Finance Committee, which has jurisdiction over many matters related to:

- federal tax policy;

- federal social safety net and health care programs, including Social Security, Medicare and Medicaid; and

- implementation of foreign trade agreements.

The Finance Committee has the broadest jurisdiction of any committee in Congress, the substance of which directly impacts Idahoans’ daily lives. For a comprehensive description of the Committee’s jurisdiction, please visit the Committee website HERE.

Pro-Worker, Pro-Business Success in Idaho

On July 4, 2025, President Trump signed the Working Families Tax Cuts into law. This legislation not only prevented the largest tax hike in history, but it also restored and made permanent critical pro-growth tax provisions that are already increasing domestic investment and boosting economic growth. Moreover, through policies like the New Markets Tax Credit (NMTC), communities of low- and middle-income families have new opportunities to flourish.

The NTMC program incentivizes investment in low-income and rural communities across the country. These incentives have contributed to making Idaho one of the fastest growing states in our nation: over the past 20 years, the program has brought $470 million in private capital to projects across Idaho.

Business owners feel confident making major investments in new production facilities and other infrastructure when they have certainty. As Chairman of the Finance Committee, my top priority was to secure a permanent expansion of the NMTC and other pro-growth tax provisions to help fuel the economy.

Watch this video about Pipeline Plastics (or click the image below), a new facility in Rupert, to see how the Working Family Tax Cuts are already creating jobs for Idahoans.

You can read more about the NMTC on my website HERE.

ICYMI: Idaho receives $185 million award to bolster rural health care infrastructure

Also under the Working Families Tax Cuts, I spearheaded the creation of the Rural Health Transformation Program (RHTP) to supply $50 billion over the next five years to support rural hospitals. Rural providers have faced challenges for years like low patient volumes and outdated technology, resulting in higher compliance costs compared to their urban counterparts. This funding will help improve quality and access to care in hard-to-reach areas.

At the end of December 2025, the Centers for Medicare and Medicaid Services announced Idaho would receive $185 million in 2026 from the RHTP. The projects supported by this grant will help Idahoans in remote areas get the care they need, even long after the program ends.

Programs like the RHTP allow states to tailor health care programs to the individual needs of their communities instead of following a one-size-fits-all federal strategy. Americans from every state have good reason to celebrate this significant investment in rural health care.

Read more via the Idaho Press HERE, or on my website HERE.

America Must Set the Tax Rules of the Road for Cryptocurrencies

In recent years, digital assets, such as cryptocurrencies, have become an important part of our global financial system. Because of its jurisdiction over federal tax policy, the Finance Committee is discussing how our tax code can provide a clear framework to ensure American leadership in this innovative industry. As Congress further discusses these novel and complex topics, the importance of getting this tax structure right becomes even more apparent. Simply put, our tax code must adapt its treatment to new and diverse cryptocurrency products and functions.

I wrote about this topic in a recent opinion piece in the Bonner County Daily Bee. You can also read it on my website here.

Continuing to Address Health Care Affordability

As we enter the second half of the 119th Congress, health care affordability remains one of the biggest issues in America. U.S. Senator Bill Cassidy (R-Louisiana) and I put forward a fiscally responsible proposal to reduce premiums, save taxpayers’ money and give Americans control over their health care. In line with President Trump’s call to give money directly to patients instead of large insurance companies, our plan would provide pre-funded Health Savings Accounts (HSAs) for low-income families. Families could use that money to cover costs not handled by their insurance policy, resulting in lower costs as care providers compete to offer better value to patients.

Although Democrats rejected that plan, Republicans will continue to seek fiscally sustainable reforms that address the root causes of rising health care costs. We cannot continue to throw good money after bad policy to paper over the cracks in our health care system.

Hear more in my recent interview with KTVB HERE. You can also read and hear more about what I have said as Chairman of the Finance Committee through the following links:

- Americans Should Control Their Own Health Care

- A Missed Opportunity for Real Health Care Reform

- Obamacare Has Undermined Health Care in America

About Mike Crapo

Senator Mike Crapo has represented Idaho in the Senate since 1999, following three terms in the U.S. House and eight years in the Idaho State Senate. A lifelong Idahoan, he currently serves as Chairman of the Senate Finance Committee.