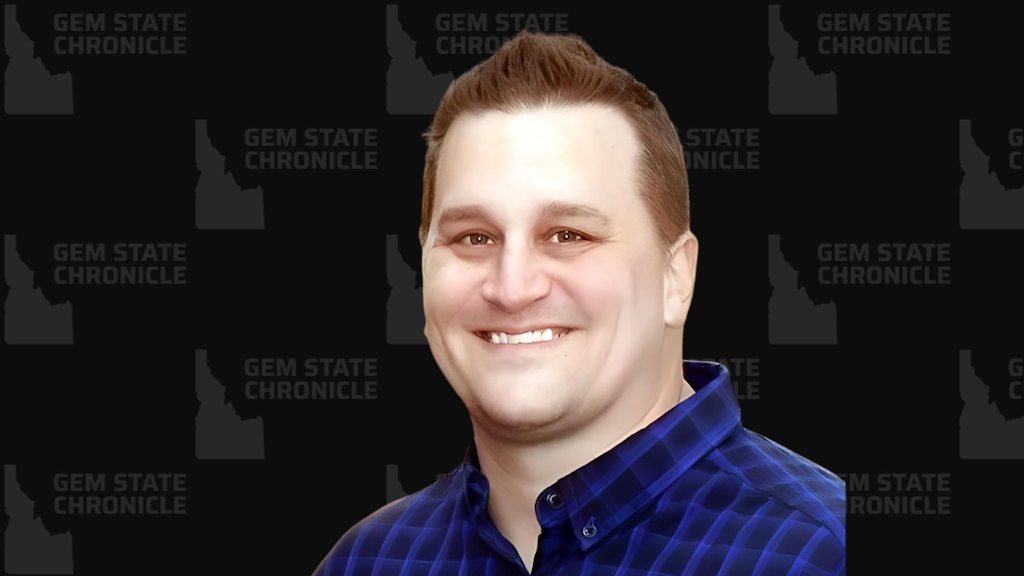

By Attorney General Raúl Labrador

Dear Friends,

Yesterday, the Idaho Supreme Court unanimously rejected a constitutional challenge to HB93, Idaho’s School Choice Tax Credit, allowing families who have already applied to move forward with the program. My office successfully defended the law, with my Solicitor General, Michael Zarian, arguing the case before the Court last month.

This decision confirms that Idaho’s constitutional requirement to maintain a system of public schools does not prevent the Idaho Legislature from doing more to expand educational opportunities. The Court rejected the petitioner’s narrow reading of the people’s dually elected representative’s power to legislate education matters. This ruling is a victory for Idaho families and affirms their freedom to choose the educational path that best fits their children’s needs and futures.

A group of petitioners, including the Idaho Education Association, the Latah County school district, and the Committee to Protect and Preserve the Idaho Constitution, filed a petition asking the Court to block the Tax Commission from implementing the program which opened for public applications last month. They argued that Article IX, Section 1 of the Idaho Constitution prohibits the legislature from funding any K-12 schools that are not public schools, and that the tax credit primarily serves private rather than public interests.

The Court dismissed those arguments. Chief Justice Bevan, writing for the unanimous Court, held that Article IX, Section 1 “establishes a floor, and not a ceiling” on legislative authority over education. When the Constitution mandates the legislature “establish and maintain” a system of public schools, the Court stated, “it is not reasonable to read that mandate as restricting the legislature’s broader power to do something more.”

On the public purpose challenge, the Court deferred to the legislature’s stated objective of expanding parental choice, finding the purpose neither arbitrary nor unreasonable. The Court noted that education is universally regarded as a public purpose and that incidental benefits to private entities do not change that.

The decision was unanimous, and the Court awarded attorney fees to the State and costs to both the State and the Idaho State Legislature.

This ruling aligns with what Idahoans have consistently said they want. Three independent statewide polls show consistent support from Idahoans on school choice tax credits.

- December 2024 (before passage): 66 percent in support

- October 2025 (after enactment): 64 percent in support

- January 2026: 65 percent in support

That number jumps even higher among parents, with polling by EdChoice and Morning Consult showing78 percent of Idaho parents support the tax credit.

The School Choice Tax Credit provides up to $5,000 per student in refundable tax credits for qualified educational expenses including tuition, tutoring, curricula, and assessments. Families with children who have certain disabilities can receive up to $7,500. The program gives priority to families earning less than 300 percent of the federal poverty level and allows advance payments so families can afford educational options immediately. Like other tax credits in Idaho law, the program reduces a family’s tax liability based on how they spend their own money. The program does not take funding from public schools, does not grant government authority over nonpublic schools, and does not require schools to alter their admissions policies, curriculum, or practices.

Since taking office, I have always made defending parental rights and protecting Idaho families a top priority. I am proud of the work our team did defending this law and I’m grateful that Idaho families now have more choices for their children’s futures.

Best regards,

About Raúl Labrador

Raúl Labrador is the 33rd Attorney General of Idaho. The Office of the Attorney General provides legal representation for the State of Idaho. This representation is furnished to state agencies, offices and boards in the furtherance of the state's legal interests. The office is part of state government’s executive branch and its duties are laid out in the Idaho Constitution.