On August 14, 1935, President Franklin Roosevelt signed the Social Security Act into law. Designed to provide payouts to retirees as well as widows and children, many progressive New Dealers considered Social Security the first step toward a total welfare state, including a national health insurance system. FDR was optimistic about the idea:

I see no reason why every child, from the day he is born, shouldn’t be a member of the social security system. When he begins to grow up, he should know he will have old-age benefits direct from the insurance system to which he will belong all his life. If he is out of work, he gets a benefit. If he is sick or crippled, he gets a benefit… From the cradle to the grave they ought to be in a social insurance system.

I’m sure that many proponents of Social Security and other welfare programs had good intentions. Elderly people, widows, orphans, and those who had become disabled were finding it hard to survive, especially as industrialization changed the face of our country. Leaders like FDR and his Secretary of Labor Frances Perkins wanted to use government power to help them.

Yet any government welfare program inevitably changes incentives—especially once Americans lost their sense of shame in using them. Social Security led to Medicare and Medicaid, which led to Obamacare and Medicaid Expansion, with food stamps, Section 8 housing vouchers, and other taxpayer-funded programs along the way. Today we have an entire ecosystem of government welfare, along with a service industry dedicated to helping people extract as many benefits as possible.

Welfare programs grow larger by their very nature. In 1940, five years after Social Security’s creation, total benefits paid out were $35 million. By 2023, that number had risen to $1.38 trillion, and today more than 70 million people receive Social Security benefits. Nearly 70 million are enrolled in Medicare, and nearly 80 million are on Medicaid.

Medicare is a federal program to help cover healthcare costs for retirees, while Medicaid is a joint federal-state program for disabled people, pregnant women, low-income families, and others. Medicaid Expansion, created as part of Obamacare and brought to Idaho by ballot initiative in 2018, covers able-bodied working-age adults who fall below an income threshold.

The share of Medicaid paid by the federal government versus Idaho taxpayers is determined by the Federal Medical Assistance Percentage (FMAP), which is based on each state’s per capita income relative to the national average. Poorer states get higher subsidies, and wealthier states get lower ones. Idaho’s FMAP fell below 70% in Fiscal Year 2024 and is 66.91% for FY 2026.

In plain English: the more prosperous Idaho becomes, the larger share of Medicaid costs must be paid by Idaho taxpayers.

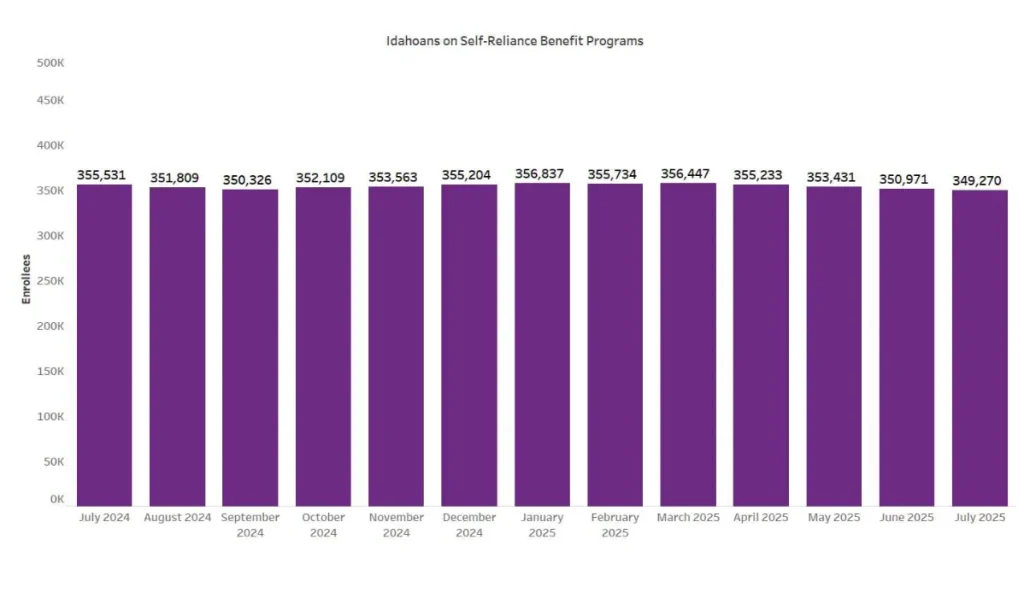

According to the latest monthly report from the Department of Health & Welfare (DHW), the number of Idahoans on benefits has decreased over the past year. In July 2024, 351,746 people were enrolled in Medicaid, compared to 347,077 in July 2025. That’s a good thing. I believe that the success of a welfare program should be measured by how many people come off it.

Nevertheless, despite rising incomes, falling enrollment, and cuts to provider rates, costs continue to grow. Wayne Hoffman linked to DHW’s FY2027 budget request in an excellent article yesterday:

Gov. Brad Little and state lawmakers are now facing an even bigger hole in the current year’s budget than anticipated. The Idaho Department of Health and Welfare says it needs another $60 million in support from state taxpayers during the fiscal year that ends June 30, while the Idaho Department of Correction is asking for an extra $11 million.

And those figures already have the governor’s midyear emergency spending cuts factored in.

DHW’s budget request runs nearly a thousand pages, but here are the key Medicaid benefit numbers (excluding administration and other costs), as extracted by Google Gemini:

- FY2027 Total Request: $5,239,804,200

- FY2026 Original Appropriation: $5,012,938,600

- FY2026 Estimated Expenditures: $4,988,047,800

- FY2025 Total Appropriation: $4,889,214,400

- FY2025 Total Expenditures: $4,763,417,700

As we’ve seen with Social Security, once a welfare program is established, it grows like a snowball rolling downhill, growing larger and harder to stop.

In response to Gov. Brad Little’s executive order directing agencies to cut 3% of their FY2026 budgets, DHW announced a 4% cut in provider reimbursements. Deputy Director Juliet Charron of DHW’s Division of Medicaid, who will succeed DHW Director Alex Adams later this month, explained that trustee and benefit costs make up 96% of the Medicaid budget:

Medicaid is reviewing its operating expenditures and contracts to identify potential internal savings and will take appropriate actions. However, since trustee and benefit (T&B) costs make up more than ninety-six percent (96%) of Medicaid’s budget, it is not possible to offset budget increases through internal actions alone.

DHW must take action to reduce the T&B trendline, which is driving the budget growth. DHW will continue to evaluate the need for additional actions over the coming months and will keep providers and stakeholders apprised of any next steps.

We appreciate the early course correction from the Governor’s Office and the Division of Financial Management to allow for as minimal impact as possible to provider rates and covered services. While we continue to monitor budget needs, it is clear that waiting until the legislative session to make changes could have yielded steeper rate changes and service reductions.

As a taxpayer, I appreciate DHW’s efforts to rein in costs. But on the other side are healthcare providers whose margins are shrinking. Doctors must pay their bills too, including expensive student loans. Most patients are tied to big insurance systems or government programs, so the market price signals that should manage spending are completely distorted.

The incentives created by government welfare extend not just to recipients, but also to providers maximizing profits and to states shifting costs onto the federal government. I wrote about this last April, citing research by Idaho’s own Niklas Kleinworth:

My friend Niklas Kleinworth recently left the Idaho Freedom Foundation to work for Paragon Health Institute in Washington, D.C. There, he coauthored a major paper outlining how states exploit Medicaid to shift their own costs onto federal taxpayers:

In what is best described as legalized “money laundering,” health care providers send money to states through a tax “scam” (former President Biden’s description), states use those funds to grow Medicaid spending using federal matching dollars, and providers (those original taxpayers) benefit from higher payments for services they provide to Medicaid recipients. States support these financing schemes, as they enable them to obtain federal funds without any actual state contribution—and they repurpose these funds for additional Medicaid spending, other state spending, or tax cuts.

Kleinworth recently broke down this issue in a radio interview that is well worth your time.

So what can we do in Idaho? Even though DHW is reducing dependency and has cut provider rates, costs keep climbing.

Why?

There is the decreasing FMAP, of course. There are also the lingering effects of inflation—costs have dramatically increased across all industries over the past five years. Finally, as noted in Director Adams’ FY2027 budget request, usage of services covered by basic Medicaid programs is increasing as well.

This comes back to the point I made in my article last April:

The fundamental structural problem in Medicaid, as in any welfare program where the government pays the bills, is that unlike in a free market, there is no incentive to control costs. Patients have little reason to resist unnecessary tests or procedures, and providers are incentivized to do more, not less, since government reimbursement flows accordingly. Since the federal government covers 60–90% of costs, states also have minimal incentive to rein in spending. At the end of this chain lies a bottomless well of printed or borrowed money, an illusory pot of gold continuously replenished by mortgaging future generations.

Did Franklin Roosevelt know what he was setting into motion in 1935? I think he did. Remember he envisioned a cradle-to-grave welfare system that ensured no American ever experienced poverty or want. In his 1941 State of the Union Address, his first since winning an unprecedented third term in the White House, FDR outlined his vision for humanity following World War II and the Great Depression:

In the future days, which we seek to make secure, we look forward to a world founded upon four essential human freedoms.

The first is freedom of speech and expression—everywhere in the world.

The second is freedom of every person to worship God in his own way—everywhere in the world.

The third is freedom from want—which, translated into world terms, means economic understandings which will secure to every nation a healthy peacetime life for its inhabitants-everywhere in the world.

The fourth is freedom from fear—which, translated into world terms, means a world-wide reduction of armaments to such a point and in such a thorough fashion that no nation will be in a position to commit an act of physical aggression against any neighbor—anywhere in the world.

Like so many progressives, socialists, and utopians throughout history, however, Roosevelt’s vision did not account for the iron laws of the market. Since 1941, many nations have attempted to provide for their citizens’ every need, but something has to give. This meme explains it in just a few words:

In the face of scarce resources—money, providers, etc.—every system must ration somehow:

- The British National Health Service rations by time, pushing life-saving appointments so far into the future that they may no longer matter.

- The American system rations by price, with Obamacare achieving the opposite of its promises: today, basic health plans can cost four or even five figures a month to cover a family.

- The Canadian system has developed a different approach—reducing demand by encouraging citizens to end their own lives rather than remain a burden on the system.

In 2008, corporate media mocked vice presidential candidate Sarah Palin for correctly pointing out that the end result of socialized healthcare would be death panels.

I applaud Director Adams for his work in reducing government dependency for Idahoans, and I hope incoming director Charron will continue that work. But what else can we do to plug this hole that leaks tax dollars, a hole that grows no matter what we do?

It is too soon to tell if managed care will help, but we must follow it closely to ensure it fulfills its promises.

Bigger picture, however, the best step we can take right now is to repeal Medicaid Expansion. I get it—this was enacted by more than 60% of Idaho voters, and it carried good intentions. Yet voters were sold a lie. The budget for Expansion keeps growing, with federal and state dollars adding up to more than a billion dollars a year, just to cover able-bodied working-age adults.

I also recognize that the economy is complex. Despite low unemployment, many Idahoans are still struggling to make ends meet. Reducing government interference in the market should open more opportunities for workers, as will removing illegal aliens and reducing the number of legal guest workers. Idaho government must serve Idahoans first.

Last year, House Bill 138 would have set up guardrails on Medicaid Expansion that, if not met, would have terminated the program. Despite passing the House, H138 was denied a hearing in the Senate, with leadership believing it would fail to pass. The Legislature instead approved House Bill 345, a much broader Medicaid reform bill that added guardrails but contained no provisions for repeal.

Repealing Expansion will be difficult. The media will attack anyone who supports such legislation. The usual testifiers will say you have blood on your hands. Big Pharma will spend heavily to defeat you at the ballot box. Yet it must be done. Able-bodied working-age adults should not expect to live indefinitely on tax dollars taken from families who are working to support themselves.

The longer a government benefit exists, the harder it is to repeal. As I wrote yesterday, even in the 1950s Republicans recognized that there was no constituency to support repealing Social Security. Americans were already too invested in the system. Today, any politician who even thinks about touching Social Security is run out of town on a metaphorical rail.

The lesson here is that we must nip these government dependency programs in the bud. I don’t think it’s too late to fix our 2018 error. Let’s start the 2026 session with a bang—by ending the failed experiment of Medicaid Expansion and restoring both fiscal discipline and the dignity of work to the Gem State.

Gem State Chronicle is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

About Brian Almon

Brian Almon is the Editor of the Gem State Chronicle. He also serves as Chairman of the District 14 Republican Party and is a trustee of the Eagle Public Library Board. He lives with his wife and five children in Eagle.