During the 2025 Summer Meeting in Pocatello, the Idaho GOP voted overwhelmingly to support an initiative petition drafted by Payette County GOP Chair Howard Rynearson to eliminate sales taxes on groceries.

I’ve covered this issue extensively on the Chronicle over the past three years. Check out these articles by me and others for some background:

- Almon: The Grocery Tax is a Red Herring

- Almon: The Grocery Tax: White Whale or Red Herring?

- Smith: Idaho’s Grocery Tax Must Go

- Vidales: Sales Taxes are Fair Taxes

- Almon: The Grocery Tax Debate

- Almon: Grocery Tax Survey Results

- Almon: A Short History of the Grocery Tax

- Almon: Are Taxes Immoral?

- Spoon: If We Can Just Have Some More Courage on the Grocery Tax

I remain somewhat skeptical that eliminating sales taxes on groceries is the best way to deliver tax relief for Idahoans. However, I’m not married to any single position in this debate. As I wrote just a few days ago:

My principle is lower taxes. I’m open to conversations about the best policy to achieve that goal. Excommunicating people from the party or the movement over policy differences when they share the same overarching principle is absurd.

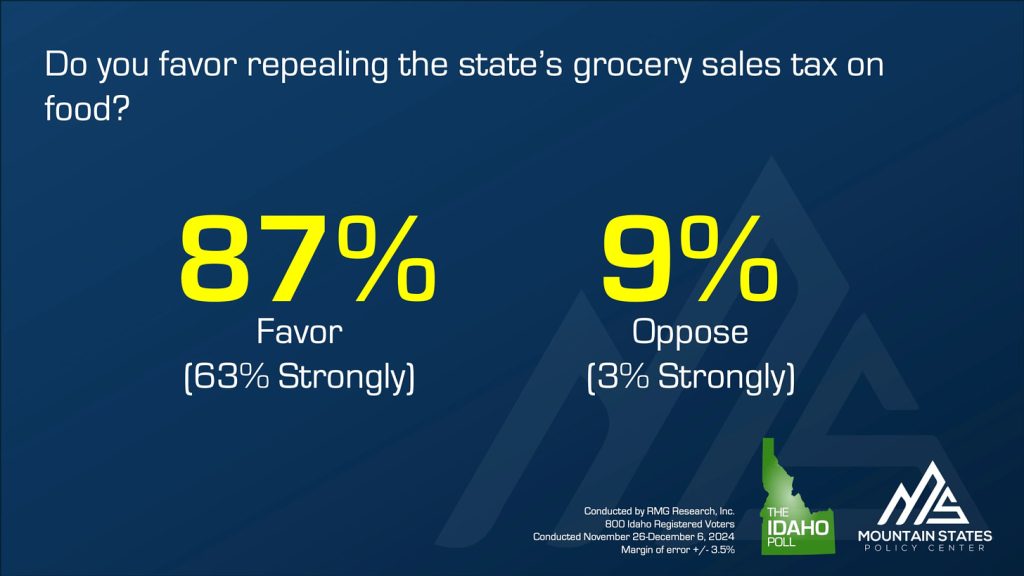

Part of that conversation is simply asking the people of Idaho what they want. It’s clear that an overwhelming majority of voters want groceries exempted from sales tax. The 2024 Idaho Poll commissioned by the Mountain States Policy Center put support at a staggering 87%.

A citizen’s initiative gives the people a chance to turn their political wishes into law. Many Republicans in Idaho are skeptical of the initiative process, since it has recently been used by progressive organizations—often funded by large national groups—to shift Idaho policy leftward. Enough voters signed the petition to put ranked choice voting on our ballot last year, but Idahoans defeated that idea by a 70–30 margin, despite proponents outspending opponents nearly 5:1.

An important part of living in a representative republic is trusting the voters. Ultimately, as recognized in both the national and state constitutions, the people are sovereign, delegating some of their God-given authority to legislatures and executives. If a large majority of citizens desire a certain policy, then at some point, it is incumbent upon their representatives to let them have their way.

If it turns out to be a bad idea, then—as H.L. Mencken put it—“Democracy is the theory that the common people know what they want and deserve to get it good and hard.”

The Idaho GOP will be gathering signatures for the petition at county fairs and other events going forward. 70,725 signatures are needed to put the initiative on the 2026 ballot. If successful, it will add to what is already shaping up to be a busy election year in Idaho. That November, voters will choose not only all 105 representatives and senators and all seven state constitutional officers, but potentially weigh in on several ballot questions:

- The Legislature has proposed a constitutional amendment declaring English as the official language of Idaho.

- Pro-abortion groups are gathering signatures for an initiative to once again legalize killing the unborn in Idaho.

- Pro-marijuana groups are gathering signatures for an initiative to decriminalize marijuana.

- At the same time, the Legislature has proposed an amendment that would remove drugs from the purview of citizens’ initiatives, which would make the former moot.

The campaign against ranked choice voting was simple: “No on Prop 1.” Next year’s campaigns will be more complex. We could see Propositions 1, 2, and 3 on the ballot, alongside multiple constitutional amendments. Each will have its own core constituency.

It’s going to be quite a ride, that’s for sure.

The text of the initiative to eliminate sales taxes on groceries is short and sweet:

Be it enacted by the people of the State of Idaho

SECTION 1. That Chapter 36, Title 63, Idaho Code, be, and the same is hereby amended by the addition thereto of a NEW SECTION, to be known and designated as Section 63-3622H, Idaho Code, and to read as follows:

63-3622H. FOOD FOR HUMAN CONSUMPTION. There is hereby exempted from the taxes imposed by this chapter the sale of food sold for human consumption. The types and kinds of food products eligible for exemption by this section shall be the same types and kinds of food products that are eligible for purchase with benefits provided under the federal supplemental nutrition assistance program (SNAP) and do not include restaurant sales of food. As used in this section, “food” shall have the same definition as provided in 7 U.S.C. 2012 as that section existed on January 1, 2027.

SECTION 2. That Section 63-3024A, Idaho Code, be, and the same is hereby repealed.

SECTION 3. That Section 63-3077G, Idaho Code, be, and the same is hereby repealed.

SECTION 4. That Section 63-3077H, Idaho Code, be, and the same is hereby repealed.

SECTION 5. That Section 32-706, Idaho Code, be, that only the brief reference to the Grocery Credit be removed.

I believe soda would be exempt from tax under this wording. While it has been removed from SNAP eligibility in Idaho as of this year, and the federal government is also moving in that direction, the initiative explicitly refers to the U.S. Code definition as it existed on January 1, 2017. In Washington, which already exempts groceries from sales tax, soda is still taxed like other goods.

I don’t drink soda anymore, so it doesn’t matter to me, but it will be interesting to see how that plays out.

Of the four repeal clauses in the initiative, only the first one really matters. (The remaining three simply eliminate references to the food tax credit from other parts of the law.) Idaho Code § 63-3024A is all about the food tax credit, which was raised to $155 per person in the 2025 legislative session.

Last January, I embarked on a research project into the history of the grocery tax and the associated tax credit in Idaho. Early repeal efforts, such as House Bill 67, which was vetoed by Gov. Butch Otter in 2017, would have both exempted groceries from sales tax and removed the credit.

However, beginning around 2021, figures such as then-Rep. Ron Nate began introducing bills that left the credit intact. Late last year, Nate wrote an article arguing that the tax and the credit were only joined in the early 21st century to justify retaining the tax. My research, however, suggests that even though the credit wasn’t formally labeled the “food tax credit” in Idaho Code until 2008, it was colloquially referred to as such from the very beginning.

Removing the credit along with the tax does make the initiative a harder sell to the public—many of whom (myself included) receive more back at tax time than they paid at the grocery store. Still, I believe it’s the right thing to do. Without the tax, the credit becomes naked redistribution.

I meticulously track my spending, including separating out non-grocery items I might buy at WinCo or Albertsons such as deodorant, cough medicine, or charcoal. I’m on track to spend about $8,000 on groceries this year, meaning I’ll pay around $480 in sales tax on food. With a family of seven, my grocery tax credit for this year’s return will be $1,085—a net gain of $605, courtesy of other Idaho taxpayers.

I certainly appreciate every penny, but I can’t in good conscience say it’s a fair policy. And this is the point opponents of the initiative will hammer. They’ll present an average family, or perhaps a low-income case study, and say that by signing this petition or voting for it in 2026, you’re taking money from those who need it most.

Are supporters prepared to make the moral case for what amounts to a tax increase on lower-income families?

I suspect that’s why Ron Nate and others dropped the idea of repealing the credit along with the tax. It’s a much harder sell. But as I said, I believe it’s the right way to go about it.

So we come to it at last: a chance for the people of Idaho to vote away a hated tax. If you’d like to sign the petition, you can do so at many locations, including the Idaho GOP booth at your local county fair. If you’d like to help gather signatures, Howard Rynearson and his team have set up a website with everything you need, including downloadable petitions.

Just remember: signatories must be registered voters, and completed petitions must be notarized before submission to your county clerk.

The proof of the pudding is in the eating, and we’ve got a big bowl of pudding before us over the next nine months. If repealing the grocery tax is truly a top priority for Idahoans, then this initiative will succeed.

Gem State Chronicle is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

About Brian Almon

Brian Almon is the Editor of the Gem State Chronicle. He also serves as Chairman of the District 14 Republican Party and is a trustee of the Eagle Public Library Board. He lives with his wife and five children in Eagle.