On Monday evening, I received an email blast from Young Americans for Liberty (YAL) warning of a looming property tax increase in Ada County.

The email encouraged readers to attend Tuesday night’s county budget hearing and to email the Ada County Board of Commissioners. I spoke with Commissioner Rod Beck, who said the county had received about 120 emails by the end of the day. He shared with me a response the county put together for everyone who took the time to reach out:

Of course, everyone surely realizes the true purpose was to collect a few more email addresses. Tuesday’s hearing was the culmination of a six-month budget process, not a last-minute sneak attack. I don’t recall YAL urging public involvement last month when the county was actively taking public comment on the proposed budget.

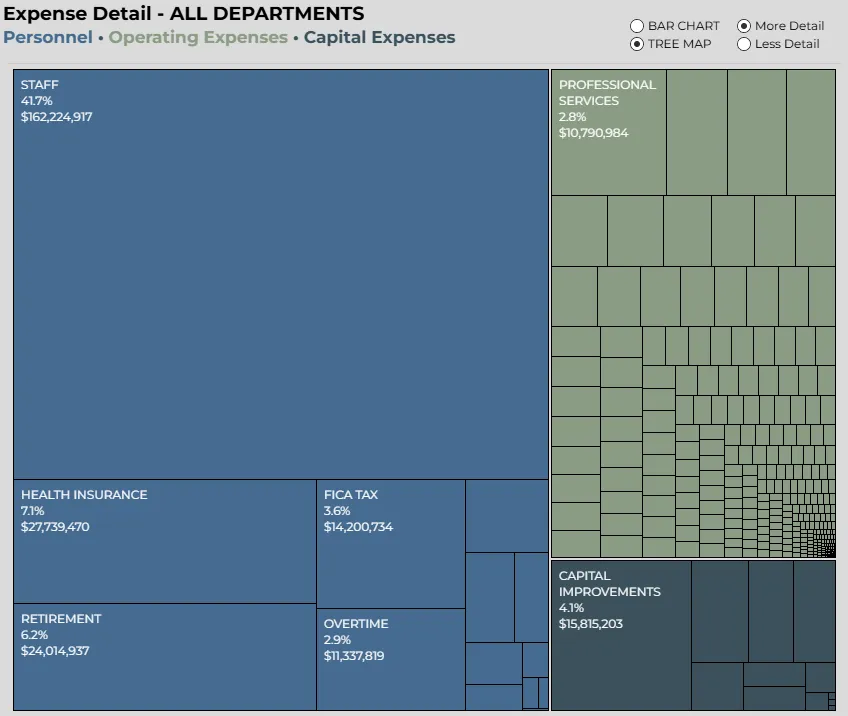

In any case, I attended the hearing myself to better understand how our county government spends our tax dollars. Clerk Trent Tripple gave an overview of the proposed Fiscal Year 2026 budget, along with a demonstration of Ada County’s Budget Explorer tool. I live-tweeted the presentation that night.

To be honest, Budget Explorer is pretty darn impressive. It lets residents drill down to every penny taken in or spent by county government. If the keyboard warriors upset about taxes want to make a difference, I suggest spending time in the app to see exactly where their money is going. I know the commissioners would welcome concrete ideas on where to cut.

Of all the taxing districts in Idaho, Ada County stands out for its transparency and efficiency. Back in FY 2022, the first year on the board for Commissioners Rod Beck and Ryan Davidson, the county cut taxes by $12 million. Taxes have increased gradually since, but collections still haven’t caught up to pre-2022 levels, even as the population has grown by more than 50,000 and inflation has exceeded 24%.

Indeed, the 2.9% property tax increase in the FY 2026 proposed budget is the highest since the three Republican commissioners took office. In FY 2022 and FY 2023, the county did not raise taxes at all, and it opted for increases of 2.3% and 1.785% in FY 2024 and FY 2025, respectively. Because the county did not take the full 3% in those years, it has the authority to collect an additional 1% in foregone taxes, but has declined to do so each year, including in this proposed budget.

Davidson noted during the hearing that many of the county’s capital projects are structured as public-private partnerships that generate revenue rather than consume it. The new soccer field at Expo Idaho is one example.

Clerk Tripple also pointed out that the number of county employees per capita has remained relatively flat for the past 15 years. In FY 2022, the county employed 42 people per 10,000 residents; today, that number is 39.

In her email, YAL’s Idaho field manager Sulamita Rotante claimed that “this bloated budget includes many redundant positions and salary increases for every county employee for cost-of-living raises.” Forgive me for being skeptical that she actually examined the budget to find these “redundant positions”—even with how easy Budget Explorer makes it. That’s just the usual script when engaging in chaos for clicks, since it never fails to outrage voters.

The other charge—that cost-of-living raises are wasteful—comes up often in budget debates. I understand the desire to minimize government salaries, but if public service pays too little, we won’t attract or retain competent employees. It’s fine to say that government jobs shouldn’t be about the money, but it’s still a job, and departments must remain competitive. Otherwise, talented staff leave, and taxpayers bear the cost of constant recruitment and training.

Tripple stated that the proposed budget includes 1.5% cost-of-living adjustments and 2.5% merit raises, which is still less than what the state legislature authorized this year through its Change in Employee Compensation process.

If you’re looking for a taxing district with a more aggressive approach to spending, look no further than the City of Boise. In an op-ed last week for the Gem State Chronicle, Boise resident and District 19 GOP chair Lynn Bradescu criticized the city’s FY 2026 budget:

On July 15, 2025, the Boise City Council approved the FY26 budget, including a 4% property tax increase—3% allowed by law plus a 1% forgone hike—ignoring the financial strain on residents. As one of the few voices opposing this budget, I’m dismayed by the council’s disregard for taxpayers and the chorus of speakers who showered praise on the council, mayor, and staff. This near-unanimous applause, with only four dissenters, was truly horrifying, revealing a disconnect between City Hall and Boise’s hardworking families.

According to the city’s budget book, Boise plans to collect $204.6 million in property taxes in FY 2026, compared to $181.6 million for Ada County. That might seem comparable until you consider population: Ada County has about 536,000 residents, while Boise has roughly 253,500.

On a per-capita basis, that means Ada County collects about $339 per person, while Boise collects $807. And because Boiseans are also Ada County residents, their combined property tax burden exceeds $1,100 per person.

To be fair, cities and counties have different mandates. Boise maintains parks, libraries, public safety departments, and the airport, among other services. Residents expect more from the city than the county.

However, there’s little doubt that Boise is experiencing some diseconomy of scale. The city plans to add 68 new full-time positions in FY 2026, including double-digit increases in police, fire, parks, and planning.

Boise also proposes spending $11.4 million on community engagement, which includes $1.3 million for the Office of Equity and Inclusion. Additionally, nearly $1 million is budgeted for site preparation at the new Interfaith Sanctuary location on State Street.

Perhaps this is simply what a majority of Boise residents want—or at least those who show up to speak at council meetings. As Bradescu noted, only four attendees at the budget hearing opposed the proposal.

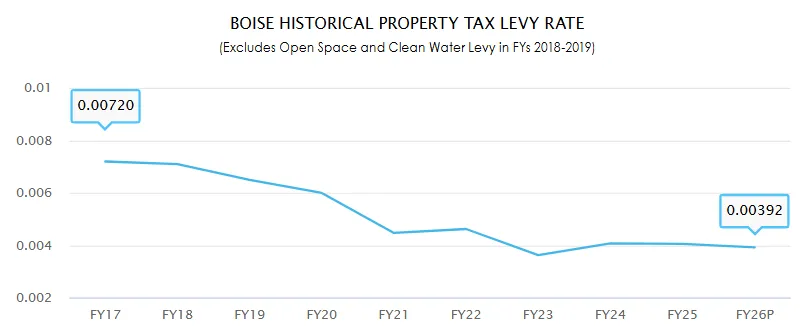

Additionally, thanks to rapid growth and a strong local economy, municipal governments are flush with cash. This has allowed them to increase spending without giving property owners sticker shock. Boise’s levy rate has remained flat in recent years despite rising revenues:

Ada County’s levy rate is still being finalized, but it too is likely flat or even down as new construction and ever-increasing housing prices drive property values higher. That means that despite the county’s 2.9% tax increase, your actual bill might not necessarily go up. (For more on how property tax levies work, see this article from last year.)

Nevertheless, as Lt. Gov. Scott Bedke told the crowd at the Gem County Lincoln Day Dinner earlier this year, it’s not the bad years that hurt, but the good ones. The more government spending grows during a booming economy, the harder the crash will be when the next downturn inevitably arrives.

Don’t forget that Ada County has 40 additional taxing districts, from cities and school districts to mosquito abatement and cemetery boards. Each one must hold open meetings, set budgets, and comply with statutory mandates. Yet for all the social media outrage, very few people take time to participate in these processes.

The future belongs to those who show up. If you trust your elected officials to wisely manage public money, then there’s nothing to worry about. But if you want to see the numbers for yourself and hold leaders accountable, there’s no substitute for showing up.

Gem State Chronicle is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

About Brian Almon

Brian Almon is the Editor of the Gem State Chronicle. He also serves as Chairman of the District 14 Republican Party and is a trustee of the Eagle Public Library Board. He lives with his wife and five children in Eagle.