In 1953, General Motors President Charles Wilson, who had been nominated as Secretary of Defense by President Dwight Eisenhower, said, “For years I thought what was good for our country was good for General Motors, and vice versa.” The idea that a rising tide for corporate America lifts all boats on Main Street has long been conventional wisdom. But what happens when corporations become unanchored from the communities from which they sprang?

Just a few short years ago, Micron CEO Sanjay Mehrotra stood beside President Joe Biden and Sen. Chuck Schumer to celebrate a $6.1 billion investment from American taxpayers in the semiconductor company. The corporation announced plans to build two new factories in New York and one more here in Boise, next door to its existing location.

Everyone in that video looks pretty excited about all the tax dollars they’re getting, don’t they? I remember when “investing in America” meant companies putting down roots here, providing good jobs for American workers, and producing for the American people. Now, apparently, the only way to keep companies like Micron in the United States at all is to deliver trucks full of money.

This isn’t the first time Micron has reaped the benefits of taxpayer subsidies. In 2008, the Idaho Legislature passed a bill granting a massive tax break to any corporation investing at least $1 billion in the state over seven years. The goal was to lure Areva, a French nuclear company, to build a facility near Idaho Falls. Areva didn’t bite—but Micron did. Having previously secured legislation to cap its taxable property value at $800 million, the company invested enough to qualify for the new law, which permanently capped its taxable property value at just $400 million. As a result, Micron paid less than $5 million in property taxes in 2019, about a quarter of what it would have owed the city of Boise and Ada County without the benefit of that law.

Micron isn’t the only tech company to benefit from Idaho taxpayers. In 2020, the Legislature passed another bill granting a sales tax exemption to companies investing at least $250 million in the state. Meta, the parent company of Facebook, used this tax break to begin construction on a new data center in Kuna. While the construction phase employs hundreds of workers, the facility will reportedly employ only about 100 people once operational, which seems to be a small number for such a large footprint.

These property tax breaks for corporations mean higher taxes for homeowners. Remember that property taxes are calculated by taking the budgets of each taxing district and dividing them by the total taxable value within that district. Capping Micron’s value at only $400 million means everyone else must shoulder that much more of the tax burden.

Micron isn’t done collecting subsidies. Remember the new fabrication plant the company promised to build after Congress passed the CHIPS Act? According to BoiseDev, it’s being constructed under a separate ownership entity, allowing it to also qualify for the $400 million property tax cap. On the one hand, this means Micron will now pay taxes on $800 million in property value instead of just $400 million. On the other hand, it locks the company into paying taxes on a shrinking proportion of its actual total property value as its value continues to increase.

Again, what does it say when a homegrown company like Micron needs huge tax breaks and government subsidies just to stay in Idaho?

While I’m sure CEO Sanjay Mehrotra is smart and capable, his status as an immigrant to the United States illustrates the new globalist paradigm. Micron was founded in Boise in 1978 and received early funding from J.R. Simplot. However, when the company went public in 1984, it incorporated in Delaware to take advantage of that state’s favorable business laws. Despite maintaining its headquarters and a major presence in Boise, Micron is now a multinational corporation. Idaho is simply one location among many across the globe. What connection does Micron still have to Idaho beyond nostalgia?

When a company no longer feels any loyalty to the American people, its only loyalty becomes to its shareholders, which means the bottom line above all else. What fiscal argument can be made against Micron increasing profits by outsourcing or offshoring?

Micron’s own employees did not fare well during the COVID-19 pandemic. In fall 2021, the company announced a policy requiring all employees to receive the COVID vaccine or face termination. Exceptions were rare and strict. One employee, for example, attempted to claim a religious exemption; Micron fired him, and his subsequent lawsuit was unsuccessful.

I spoke with a former Micron employee who explained what it was like on the inside. Those who requested exemptions were either allowed to work under severe restrictions, such as double masks and social distancing, or placed on unpaid leave. According to this former employee, some were quietly offered their jobs back after six months. A group of employees formed an organization seeking legal remedies, but it has thus far been unsuccessful.

Meanwhile, Micron continues to do what’s best for the bottom line. In response to President Donald Trump’s tariffs, intended to bring production back to the United States, CEO Mehrotra said simply that customers would bear the burden. That may be a predictable position (as libertarians often remind us, corporations don’t pay taxes — customers do), but it doesn’t inspire confidence that Micron is interested in giving back to the people who have given it so much. In a globalist economy, nothing matters more than the bottom line.

And Micron’s bottom line is doing just fine. According to its 2024 earnings report, the company lost nearly $6 billion in 2023, but turned a profit of $778 million last year. That’s good for shareholders, and the company will surely reinvest much of that money. But it also shows how lucrative the global economy can be, especially with generous taxpayer support.

Is this just the way things are done in the 21st century? Must we accept socialized risk with privatized reward as the cost of doing business in a global economy? If not for the tax breaks and the CHIPS Act subsidies, would Micron even still be in Idaho?

I fear that this mentality will lead to places like Idaho being seen as nothing more than raw material for global corporations, and that will have disastrous consequences for our communities.

To be fair, Micron remains a valuable part of the Treasure Valley. More than 5,000 people are currently employed here, and the new expansion project promises to add another 2,000 jobs in the coming years. And there’s no doubt that it’s in America’s best interest to manufacture semiconductors domestically rather than rely on overseas production.

The question is about balance. Businesses don’t operate as charities, but neither should taxpayers. Are we getting enough in return to justify enormous tax breaks, multibillion-dollar subsidies, and controversial workplace policies?

Perhaps in 1953, it was still true that what was good for General Motors was good for America. But can we still say today that what’s good for Micron is good for Idaho?

Gem State Chronicle is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

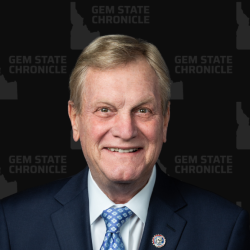

About Brian Almon

Brian Almon is the Editor of the Gem State Chronicle. He also serves as Chairman of the District 14 Republican Party and is a trustee of the Eagle Public Library Board. He lives with his wife and five children in Eagle.