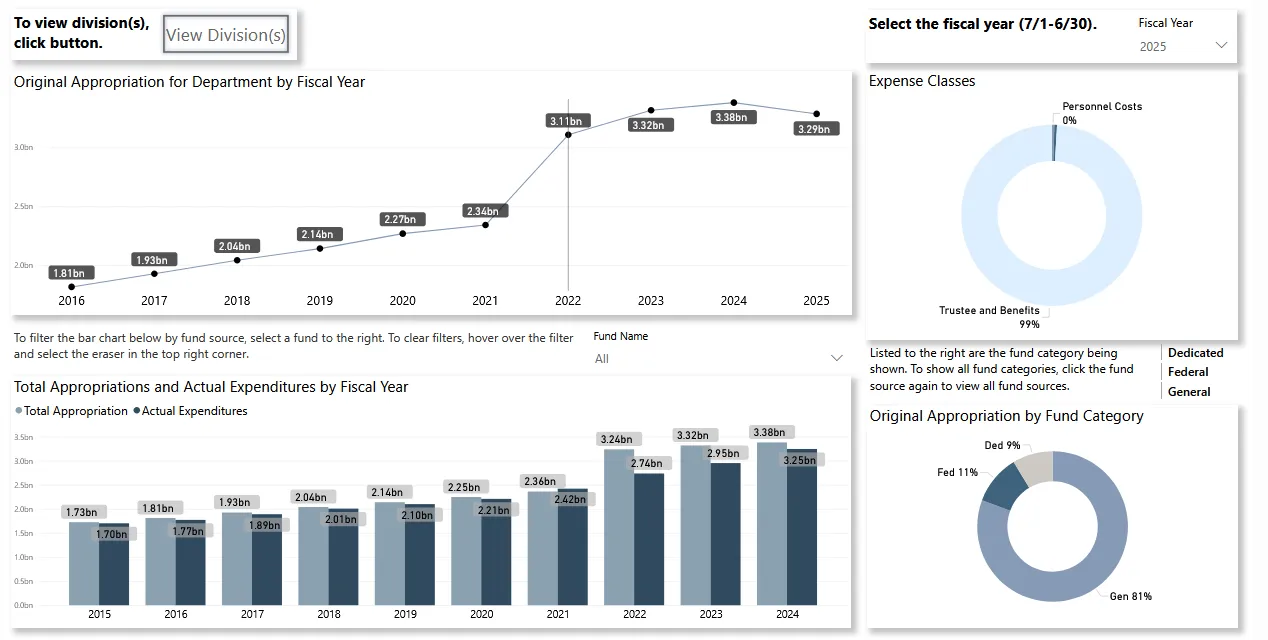

The Legislature appropriated approximately $13.9 billion this year, a mix of tax revenues, dedicated funds, and federal money. The second-largest category of expenditures in our state budget is public schools, which account for about $3.3 billion of that total. Only Medicaid consumes a larger share. Of that $3.3 billion, about $2.65 billion is directly funded by state tax dollars.

However, public school districts have the option of asking voters for more. One of the great legacies of the English political system that Americans inherited is the idea that governments cannot tax the citizenry without its consent. Indeed, one of the rallying cries of the American Revolution was “no taxation without representation,” as Parliament had levied taxes on the colonists despite their lack of representation in that body.

School districts use supplemental levies to pay for costs above and beyond what the state funds directly. These levies require a simple majority of voters to pass and must be renewed every two years. Districts once had four election dates available, but the Legislature removed the March and August dates in recent years due to low turnout, leaving only May and November. Supplemental levies are defined in Title 33, Chapter 8 of Idaho Code:

Supplemental Maintenance and Operation Levies. No levy in excess of the levy permitted by this section shall be made by a noncharter district unless such a supplemental levy in a specified amount and for a specified time not to exceed two (2) years be first authorized through an election held subject to the provisions of section 34-106, Idaho Code, and pursuant to title 34, Idaho Code, and approved by a majority of the district electors voting in such election.

Bonds face even more stringent requirements. A bond is essentially a loan used to pay for something immediate—such as the construction of a new school building—which is then repaid over several decades. Government entities that issue bonds must raise taxes to make regular payments for the life of the loan. Article VIII, Section 3 of the Idaho Constitution requires that any such public debt be approved by a two-thirds vote:

No county, city, board of education, or school district, or other subdivision of the state, shall incur any indebtedness, or liability, in any manner, or for any purpose, exceeding in that year, the income and revenue provided for it for such year, without the assent of two-thirds of the qualified electors thereof voting at an election to be held for that purpose

This supermajority threshold is one of the highest in the nation, which makes bonds difficult to pass in Idaho. According to Idaho Education News, only 26% of school bonds have passed since 2016. All three bonds on the ballot this week—in Shelley, Filer, and Middleton—failed. This represents a rejection of $150 million in proposed new taxes by voters in those districts. Of the three, only Middleton even achieved a simple majority, while 78% of voters in Filer rejected their district’s proposed bond.

Idaho voters were more inclined to support supplemental levies, however. Idaho Education News reported that of the 24 levies on the ballot this week, 22 passed. Some were replacement levies, leaving tax rates mostly unchanged, while others represented new taxes. In all, a combined $75 million in property taxes was on the docket last Tuesday.

Hopefully, all sides can learn something from these results. Officials in districts where bonds and levies failed may be tempted to simply demand more money from the Legislature—despite a billion-dollar increase in appropriations over the past few years and several recent bills that allocate additional funds for school maintenance and construction. Instead, they should talk to their voters and find out why they’re unwilling to pay more. Many Idahoans have concerns about the direction of our public school system—from ideological indoctrination to bloated administrative costs. Let’s see some effort to address those problems before asking for more money.

On the other hand, officials in districts where levies passed will see those results as an affirmation that they’re on the right track. For conservatives in those districts who don’t believe the schools have earned those extra tax dollars, it’s time to engage with your neighbors. Learn why they were willing to vote for higher taxes. Do they share your concerns about the public school system? Did your friends and neighbors who do share your concerns even bother to vote?

Whether you believe your local school district delivers good value for your money, or you think it’s wasteful and doesn’t deserve more, you still have to vote to make your voice heard. Voters in Valley School District rejected their levy by a mere seven votes, saving taxpayers $600,000—or $89.95 per $100,000 of assessed property value. The district will now need to cut costs to make up the difference. On the other hand, Highland’s levy passed by only four votes, which will cost taxpayers there a total of $599,000—or $263 per $100,000 of assessed value.

Turnout is key. Can we really call ourselves citizens of a constitutional republic if we fail to carry out the basic duties of citizenship? As I wrote yesterday, the next time someone complains about property taxes, I’ll ask if they voted in the May election.

Gem State Chronicle is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

About Brian Almon

Brian Almon is the Editor of the Gem State Chronicle. He also serves as Chairman of the District 14 Republican Party and is a trustee of the Eagle Public Library Board. He lives with his wife and five children in Eagle.