By Steven Thayn

The education landscape has changed. Parents are no longer bound to their local public school—or to any public school at all. However, many Idaho educators and policymakers still operate as if it were the 1950s when students attended their assigned district school. Instead of resisting school choice measures like tax credits and vouchers, public educators should push for flexibility and innovation to remain competitive in today’s education marketplace.

I support House Bill 93 (HB 93), the Idaho Parent Choice Tax Credit, which allocates $50 million to help lower-income students attend private schools. Some argue this will financially harm public schools, but the numbers suggest otherwise. The 2024-2025 Idaho public school budget is $2.9 billion for 317,000 students, averaging $9,100 per student. The $50 million tax credit represents only 1.7% of the total education budget while serving 3% of students—a reasonable and sustainable investment in educational choice.

The Positives of HB 93

- Controlled Implementation – A $50 million cap ensures a gradual, manageable rollout.

- Targeted Support – Prioritizes low-income families, expanding educational opportunities for those who need them most.

- Prevents Tuition Inflation – The $5,000 per-student cap (except for special education) helps avoid excessive tuition hikes.

- Reduces Conflicts of Interest – The program is run through the Idaho Tax Commission, not the Idaho Department of Education.

- Long-Term Taxpayer Savings – If 100,000 students use the tax credit in the future, taxpayers could save $400 million annually as fewer students attend public schools.

Concerns About HB 93

- Loss of Engaged Parents in Public Schools – Many parents seeking alternatives are highly involved. Their departure may reduce innovation and reform in public schools.

- Lack of Public School Flexibility – Without additional reforms, public schools may struggle to adapt to an evolving education landscape.

Why Senate Bill 1068 Is Needed

Senate Bill 1068 addresses these concerns by introducing key reforms that help public schools remain competitive.

- Encourages Public School Innovation – Schools can collaborate with parents in new ways to stay competitive.

- Expands Curriculum Choice – Unlike HB 93, which enables curriculum choice indirectly, SB 1068 allows parents to directly select their child’s educational materials.

- No Additional Fiscal Cost – The bill enables innovation within existing funding structures.

- Introduces a $1,800 Education Savings Account (ESA) Option – Some schools already offer ESAs, supporting personalized learning at no extra taxpayer expense.

- Keeps Engaged Parents in Public Schools – Alternative learning models within the public system help retain reform-minded parents.

- Supports Flexible Learning Models – Allows instruction at home, online, or in schools using a hybrid approach tailored to each child’s needs.

Conclusion

While HB 93 is a step toward expanding school choice, it must be paired with reforms allowing public schools to innovate and compete. Senate Bill 1068 provides the flexibility needed for a balanced and dynamic education system in Idaho. Supporting both bills ensures an education system that empowers families, strengthens both public and private schools, and meets 21st-century needs.

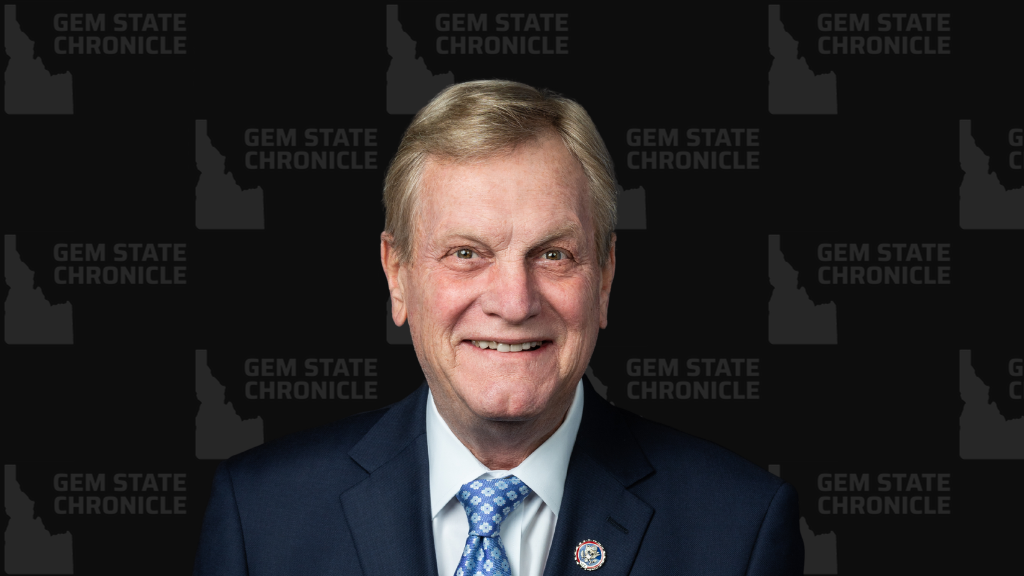

Steven Thayn is from Emmett, Idaho. He is the former Chairman of the Senate Education Committee and author of the Advanced Opportunities Program and Self-Directed Learner law. He was instrumental in writing SB 1068.

About Steven Thayn

Steven Thayn is a father, grandfather, former Idaho state legislator, and former chairman of the District 14 Republicans. Thayn is the author of numerous books on education, poverty, healthcare, and natural law.