Paid subscribers visit Substack for a bonus note at the end of the article. Not subscribed? Click here to sign up today!

As the Legislature prepares to convene for the 2025 session, a lot of people are talking about grocery taxes. As I’ve written before, I don’t have strong feelings on the issue. Numbers-wise, the grocery tax is small potatoes, and people like me who shop frugally yet have large families are actually subsidized by the grocery tax credit. I see good arguments on both sides of the issue. However, I want to frame the debate with as much context as possible.

I’ve seen some talk the past few weeks suggesting that the so-called grocery tax credit originally had nothing to do with the sales tax on groceries, and its name was only recently changed as a way to justify maintaining that tax. After I had already researched and written much of this article, Idaho Freedom Foundation president Ron Nate published his own piece on the history of the grocery tax taking that very tack:

Let’s be clear. The tax credit in question existed for decades, unattached in statutes to grocery taxes. Only when some legislators started pushing hard to remove the sales tax on groceries did other “big-government” legislators react. They began by dubbing the tax credit a “food tax credit” and then increased the credit amount to stave off what would have been a much larger sales tax cut for Idahoans.

I encourage you to read the entire article, especially the legislative timeline of the tax credit. However, I came to a somewhat different conclusion in my own research.

There are few things I enjoy more than researching history, so once I heard this idea I set out to learn as much as possible about the history of Idaho’s sales tax, the grocery tax, and the accompanying tax credit. In addition to looking through the papers of the 38th Legislature and then-Gov. Robert Smylie, I also researched contemporary newspaper articles to learn what people were saying about the taxes at the time.

I owe an immense debt of gratitude to the staff of the Idaho State Archives for their time and assistance.

Let’s rewind 60 years. Gov. Smylie, a Republican serving his third term, sought a more stable source of revenue for government programs such as transportation and education. In his State of the State Address in January 1965, Smylie urged the Legislature to pass a “retail sales and use tax designed to produce revenue adequate to the needs of these expanded services.” A sales tax, Smylie explained, would “permit us to tap the 160 million dollar tourist traffic for revenue assistance for local programs.”

Smylie elaborated on his sales tax plan when presenting his proposed budget to the Legislature several weeks later. He called for a reduction in income taxes to offset the new tax burden that would come from a sales tax. Accordingly, the Legislature passed Smylie’s bill, H222, which included a 3% sales and use tax, a reduction in income tax levels, and a tax credit of $10 for each member of a household filing a tax return.

The new sales tax was presented to Idaho voters in the form of a referendum that November, passing with 61% approval. Over the next 40 years, the sales tax increased from its original 3% to the 6% we pay today.

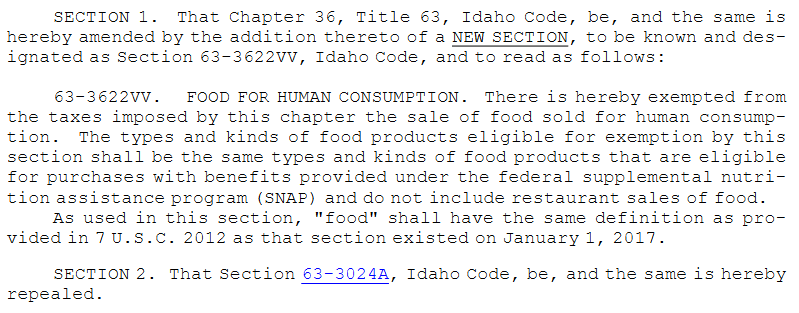

Despite being included in H222, the tax credit was not specifically called a grocery tax credit or a food tax credit in statute until 2008. House Bill 588 rewrote the statute regarding the tax credit, increasing it to $50 for low-income residents and $30 for everyone else, and referred to them as “food tax credits and refunds”. Prior to H588, that section of Idaho code — 63-3024A — was simply titled “credits and refunds”.

However, it appears that the credit has long been viewed as a tradeoff for Idaho maintaining a sales tax on groceries. As Ron Nate points out in his article today, a footnote to a 1993 bill referred to a “grocery credit”. An attempt in 2001 to amend 63-3024A used the phrase “grocery credit” in the bill title. A report on Idaho’s tax structure published in 2015 claimed that “the grocery credit was originally enacted in 1965 at a level of $10” (emphasis mine). A report by a blue ribbon commission in 1978 directly connected the sales tax on groceries with the tax credit:

Although people pay a Sales Tax on groceries, they receive a credit of $15 per person on their Income Tax. The credit is doubled for people over 65. The credit is intended to reduce the regressivity of the Sales Tax.

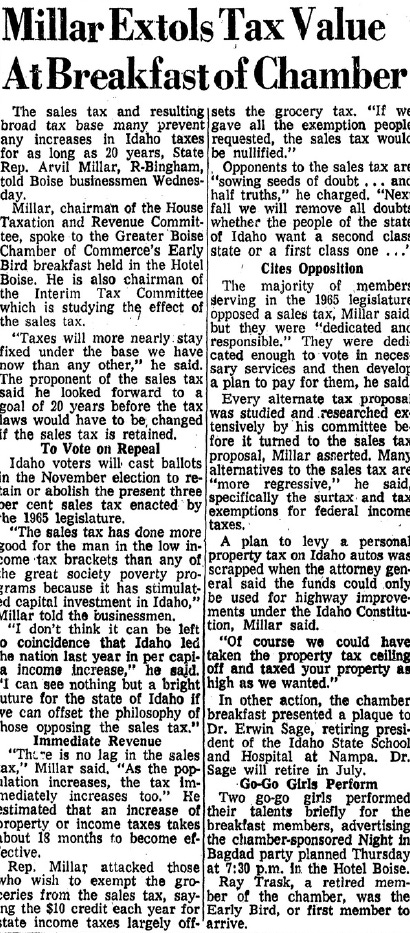

As early as April 1966, just one year after Idaho enacted the initial 3% sales tax, the Idaho Statesman quoted Rep. Arvil Millar, chairman of the House Taxation and Revenue Committee, as “attacking” those who wished to exempt groceries from the sales tax. The article paraphrased Millar as saying: “…the $10 credit each year for state income taxes largely offsets the grocery tax.”

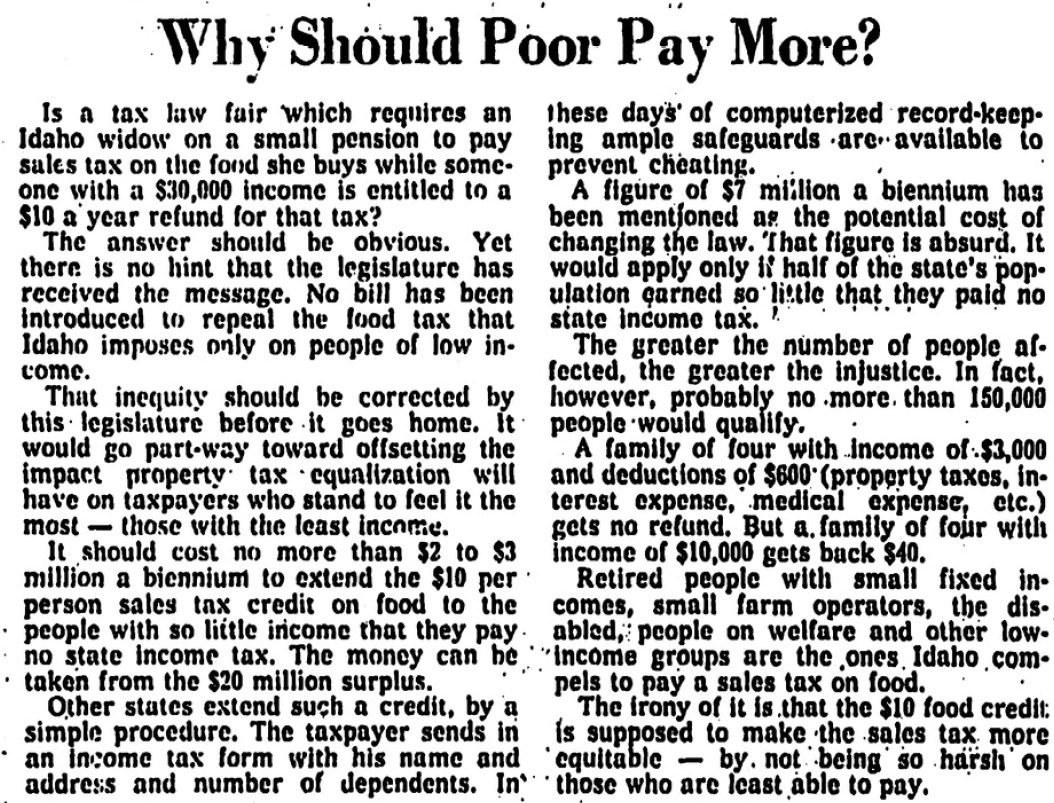

An editorial in the Idaho Statesman in March 1969 complained that elderly citizens were being cheated out of the credit because many did not file income tax returns. The author referred to the credit as the “sales tax credit on food”.

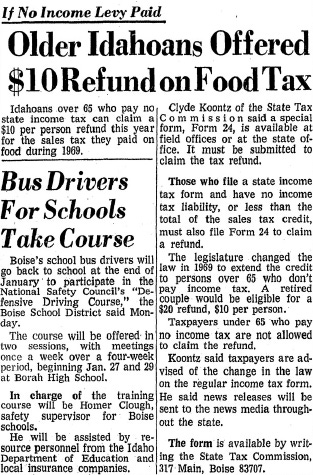

The Legislature attempted to fix the problem that very year by creating a form for any Idaho citizen who did not file an income tax return to still claim the tax credit. The headline in the Idaho Statesman on January 20, 1970 called it the “refund on food tax”.

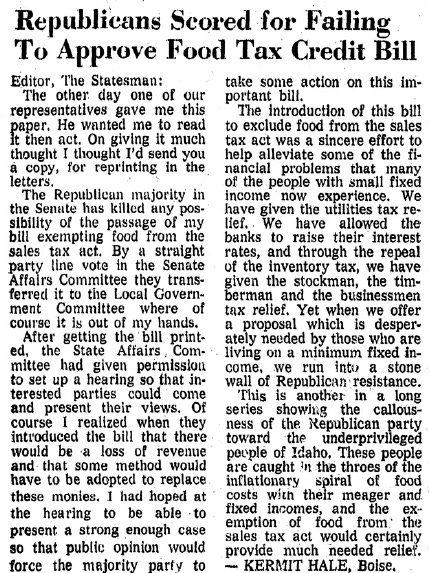

Later that session, a letter to the editor criticized Republicans for blocking a bill to exclude food from the sales tax — a reminder that the idea of eliminating the sales tax on groceries is as old as the tax itself.

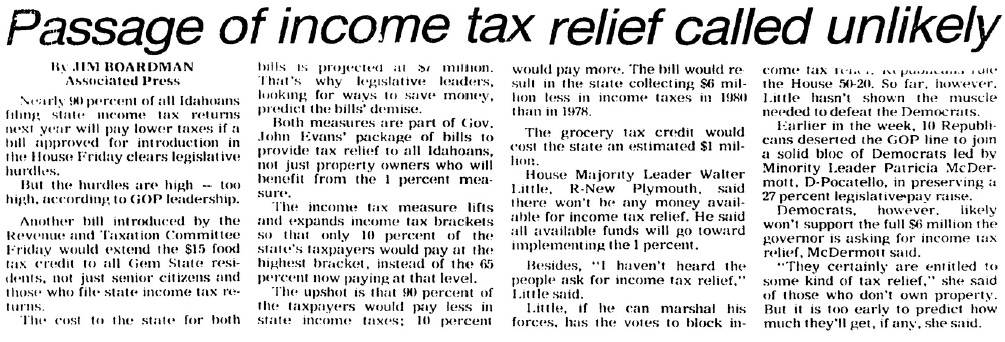

In 1979, a bill was introduced to extend the $15 tax credit for senior citizens to all Idahoans. Once again, the article referred to the credit as the “food tax credit”.

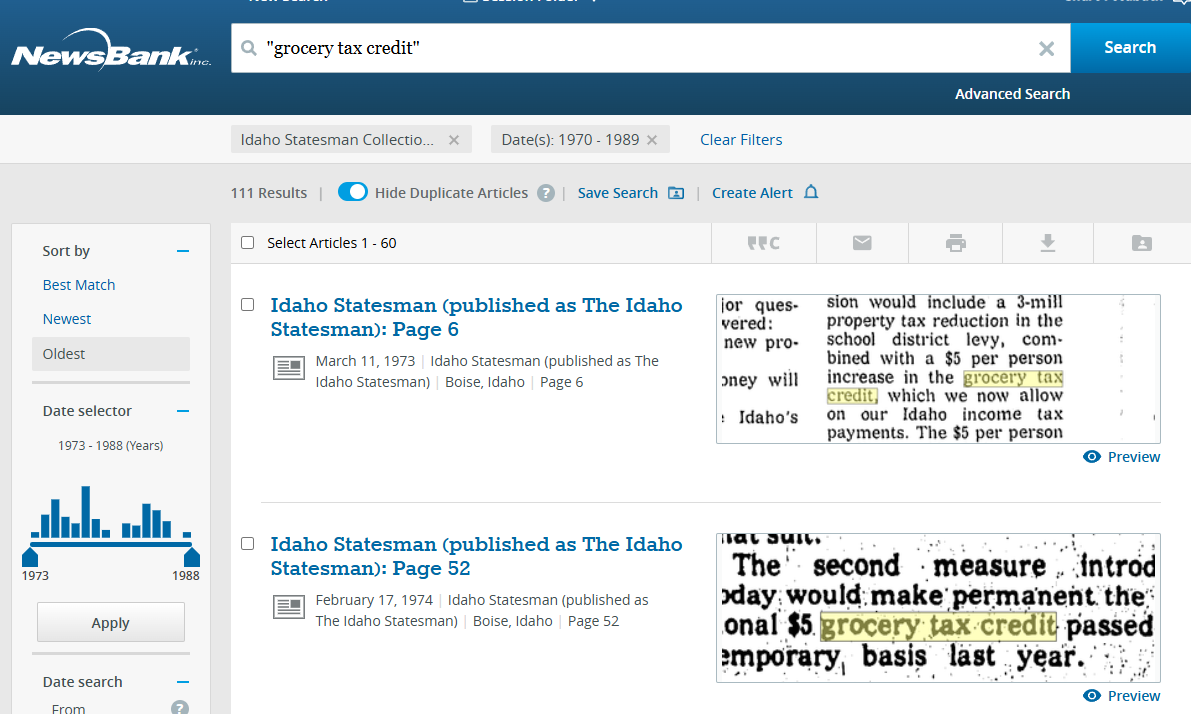

In all, I found more than 100 references in the Idaho Statesman to a “grocery tax credit” between 1970 and 1989. It is clear that, despite not appearing in statute until 2008, the tax credit was commonly associated with the sales tax on food.

I was hoping to find records of legislative debate from 1965 to learn if lawmakers intended the credit to offset taxes on groceries from the beginning, but I have not yet found any. Nevertheless, the newspaper archives show that both lawmakers and members of the public have considered the two inextricably linked for nearly 60 years. Perhaps Ron Nate is correct that it was “big-government legislators” that initially conflated sales taxes on groceries and the tax credit, but the seeds were there on day 1.

Even as late as August 2024, Nate himself referred to the credit as the “grocery tax credit,” calling it “clunky” and suggesting it would be better to not have the tax or the credit. Today’s article maintains the latter position, recognizing that a bill that both eliminated the sales tax on groceries and repealed the credit would be difficult to pass:

Some legislators insist on linking the grocery tax repeal with the tax credit repeal because doing so would likely cause the entire repeal bill to fail in the Legislature. Here’s why: If we tried to repeal both the sales tax and the tax credit together, the families most in need would see an overall tax increase, and that’s a bill stopper.

Most of the recent attempts to eliminate the sales tax on groceries would have repealed the tax credit as well. In 2017, the Legislature passed House Bill 67, which exempted food from the sales tax and completely repealed the tax credit along with it:

However, Gov. Butch Otter vetoed the bill, claiming it reduced the state budget by too much. The veto was controversial because it apparently occurred after the statutory deadline, but the Supreme Court declined to overrule it.

Since then, numerous legislators have filed bills to eliminate the sales tax on groceries, often as personal bills that bypass the normal committee process. Then-Rep. Priscilla Giddings introduced H360 in 2020 and H489 in 2022, and both would have repealed the tax credit, as would H33 introduced in 2023 by Democratic Rep. Steve Berch.

Ron Nate has been fighting to exempt groceries from the sales tax for a long time. According to a newsletter released in February 2021, then-Rep. Nate “presented a plan to exempt all groceries from the 6% sales tax while reducing or eliminating the grocery income tax credit.” Later that year, Nate attempted to send an income tax bill to the amending order hoping to add a grocery tax repeal, but that motion was defeated.

The following year, Nate introduced H448 as a personal bill to exempt food from the sales tax, but this time it did not include a repeal of the tax credit. Today, he called those who want to remove both the tax and the credit “a few squishy legislators”.

I’ve heard rumors that at least two bills that will be introduced this session: one would exempt food from the sales tax while leaving the credit alone, the other would increase the tax credit. The last time the credit was increased was via H509 in 2022, bumping it from $100 to $120 for most residents, and up to $140 for senior citizens.

The question of whether the grocery tax and the tax credit are linked or not is more than academic. IFF’s Freedom Index considers whether a bill increases or decreases government redistribution of wealth. If the two are linked, eliminating the tax while retaining the credit would result in a negative score for increasing wealth redistribution. However, if they are unrelated, eliminating the grocery tax would not be responsible for increasing the net tax credit and would therefore not warrant the same negative rating.

To give a purely positive rating to a bill that exempts food from the sales tax while leaving the credit alone requires figuring out how to separate the two, thus Ron Nate’s article this morning. In 2022, IFF rated H509 neutral, but I suspect that a bill to raise the credit this year will garner a negative rating. IFF rated H67 +2 in 2017 — this was the bill that exempted food from the sales tax and eliminated the credit but was vetoed by Gov. Otter. IFF’s analysis cited the elimination of the credit as reducing wealth redistribution.

So, with all that said, is the tax credit a “grocery tax credit” at heart, or is it simply an income tax credit that was later linked with the sales tax on groceries? Your answer will depend on your perspective.

As I’ve said, I do not feel strongly about this issue in either direction. It has long been a conservative position that sales taxes are generally more “fair” than income or property taxes. Also, many people receive just as much — if not more — back via the credit than they paid in sales tax on groceries, and this tax captures revenue from non-residents and potentially even illegal aliens living in Idaho.

On the other hand, a huge majority of Idahoans want to see groceries exempted from taxation, and legislators can’t really go wrong by giving the people what they want. Additionally, cutting any tax is always a good thing.

I sincerely hope that this research helps inform the debate on the topic. Whatever the Legislature decides, it should do so by considering solid arguments that are grounded in truth. Thomas Sowell said there are no solutions, only tradeoffs, and I hope our lawmakers make the best decision they possibly can with regards to our money and our government.

About Brian Almon

Brian Almon is the Editor of the Gem State Chronicle. He also serves as Chairman of the District 14 Republican Party and is a trustee of the Eagle Public Library Board. He lives with his wife and five children in Eagle.