Today I took I long-planned road trip from one end of the Treasure Valley to the other, taking an unscientific poll of grocery prices. I chose ten of my family’s staple items, plus one bonus treat, and compared prices at nine grocery store locations. One of the claims I’ve heard about eliminating the sales tax on groceries is that stores would simply raise their prices by 6%. Now, I try to avoid arguing about what is going to happen in any given scenario, since nobody truly knows for sure. However, there already exists a place where there is no sales tax on groceries: Ontario, Oregon.

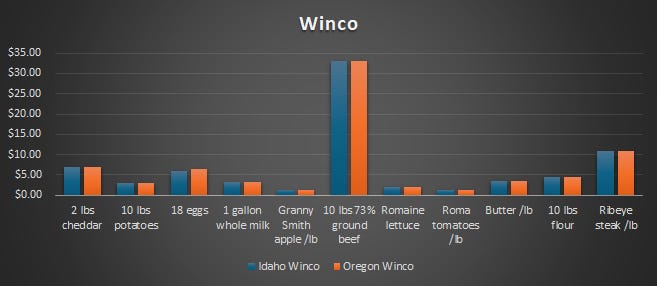

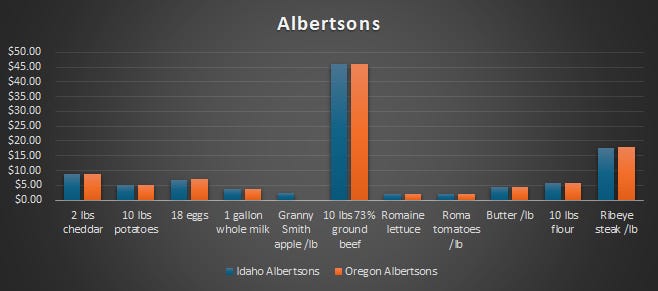

I wrote down prices of eleven basic items at Winco locations in Eagle, Boise, Meridian, Nampa, and Ontario, and also Albertsons in the same except for Eagle. I then averaged the Idaho locations and compared them to the numbers I found in Oregon. I was curious to see if the Oregon stores had higher prices to compensate for customers not having to pay the 6% sales tax.

What did I find?

Prices were virtually identical.

In the cases where the Oregon prices were different, they were still within the range of the Idaho stores. For example, tomatoes were marked down in Eagle, which brought the Idaho average down, but they cost the same in Boise, Meridian, Nampa, and Ontario.

The Albertsons in Ontario did not appear to have bulk Granny Smith apples, but the price for other apples was comparable.

The one major difference was eggs. An 18-count container was higher in Oregon than at any of the Idaho stores.

Again, this doesn’t mean that stores would not raise their prices should the sales tax on groceries be eliminated, but in the one place within driving distance where those taxes are already not present, they have not done so.

Another thing the data showed is that Winco is nearly always less expensive than Albertsons, but I knew that already. My regular grocery strategy is to get most staples at Winco, check Albertsons for sales on meat and cheese, and buy bulk stuff at Costco.

I also keep meticulous track of my finances. From December 2023 through November 2024, my family spent $7,528 on groceries. Some of that will be the occasional bottle of wine or root beer, which would likely not be exempt under any potential bill, but it’s close enough. This means that I paid just over $450 in sales taxes on food.

The current grocery tax refund in Idaho is $120 per person, so counting my wife and five children I will receive $840 back when I file my taxes next month. That’s nearly $400 in subsidies from Idaho taxpayers, or an 87% return on my loan to the government.

That’s not necessarily a good thing, but it is what it is.

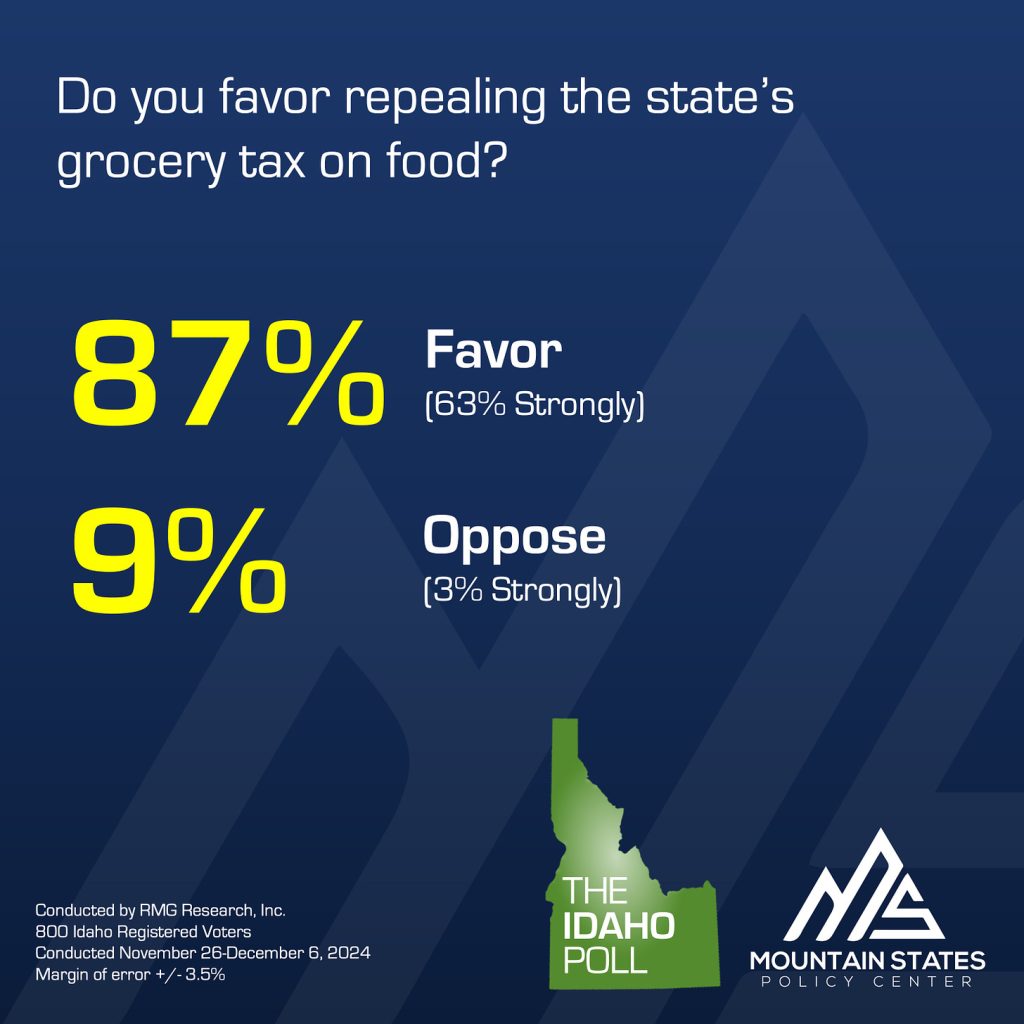

Mountain States Policy Center just released its Idaho Poll, which I’ll spend more time examining next week. When asked about grocery taxes, a large majority want to see them eliminated:

There are three things lawmakers can do with the sales tax on groceries:

- Keep the tax, maintain the credit — in other words, do nothing.

- Keep the tax, increase the credit — Give more to frugal people like me.

- Eliminate the tax, eliminate the credit — Citizens will save 6% on every shopping trip, but won’t get anything back at tax time.

- Eliminate the tax, keep the credit — This is literally wealth redistribution, even more than the current system.

It will be interesting to watch the debates in the upcoming session. I’ve heard rumor of two bills being floated — one to keep the tax and increase the credit, and another to eliminate the tax and keep the credit. We’ll see what is actually presented once the Legislature convenes. Removing the tax and the credit would see people like me — frugal with large families — lose money in the deal, which though fair might prove a hard sell. Legislators might be tempted to support keeping the credit even after eliminating the tax, which might play well with voters but is definitely not a traditionally conservative position.

The rationale for the current system is that travelers pay the tax but don’t receive the credit. I’ve heard various figures floated around, but I don’t think there’s any real way to know exactly how many groceries are being purchased by out-of-staters.

I know a lot of people feel very passionately about this issue — see the 63% in the Idaho Poll who “strongly favor” eliminating the tax — but I simply don’t feel strongly either way. Purely based on the numbers, cutting income taxes means more money in more peoples’ pockets. Property tax relief also sent a lot of money back to citizens as well. Nevertheless, this is one issue that will definitely be hotly debated starting next month, and I’ll bring it to you as it happens.

As for me, I’m going to load up on groceries at the Ontario Winco and head home.

Gem State Chronicle is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

About Brian Almon

Brian Almon is the Editor of the Gem State Chronicle. He also serves as Chairman of the District 14 Republican Party and is a trustee of the Eagle Public Library Board. He lives with his wife and five children in Eagle.