Eliminating the sales tax on groceries has long been a goal of Idaho conservatives. Our state currently has a flat sales tax of 6% across the board, which differs from many states that exempt groceries from the sales tax. To make up for it, the state issues tax credits based on family size, usually $120 per person.

In 2017, then Lt. Gov. Brad Little, having already announced his gubernatorial campaign, urged the Legislature to repeal the tax:

Fairness and competitiveness are two essentials for Idaho’s tax system. This is why I support the Legislature’s vote to repeal the sales tax on groceries. HB67 will lower the tax burden for all Idahoans while greatly improving border community businesses.

The 2017 bill to repeal the grocery tax made for strange bedfellows. In addition to Little, supporters included Rep. Ron Nate, now the president of the Idaho Freedom Foundation, Rep. Greg Chaney, recently defeated in a bid for Canyon County Prosecutor, and Democrat Rep. Grant Burgoyne, who lost election to the Boise City Council last year. Even Rep. Ilana Rubel, the Democratic leader in the House, has long supported repealing the grocery tax.

Once elected, the governor did not make eliminating the grocery tax a priority. The 2022 legislative session saw action on taxes, passing the largest tax cut in history at that time. However, the bill did not include repealing the grocery tax, despite then Sen. Christy Zito’s attempt to insert such a repeal via amendment.

Sen. Chuck Winder, the president pro tempore, said that what he was hearing at the time was that people wanted to keep the grocery tax credit but get rid of the tax, which obviously doesn’t work. Sen. Jim Rice, the sponsor of the tax cut bill, said that public policy polling indicated that the top priorities for Idahoans were property tax and income tax reform, with sales tax a distant third.

The Legislature went on to raise the grocery tax credit that year from $100 to $120.

The last two sessions have not seen much talk of a grocery tax repeal, but with a new crop of conservatives entering the Legislature expectations are high. The question is, should a bill to eliminate the tax on groceries be a top priority next year?

Chris Cargill of Mountain States Policy Center says no. In an article last month, he analyzed the costs and benefits of the tax and credit combination and concluded:

Sales taxes are more stable and pro-growth than other forms of taxation – especially income taxes. Policymakers can better serve citizens by adopting higher yearly grocery tax rebates and focusing additional tax relief on reducing income taxes.

Dustin Hurst, formerly of the Idaho Freedom Foundation and currently senior director of development at the People United for Privacy Foundation, disagreed, calling it a “trash take” and adding:

The wealthy can afford groceries and the poor have food stamps and they don’t pay grocery taxes anyway. Food prices are eating middle class folks alive.

Several years ago, in one of the first political meetings I attended, I heard Mike Moyle, before he was Speaker of the House, explain why he did not support repealing the grocery tax. He said that if they did, then grocery stores would immediately raise their prices by 6% to compensate. Others have called that nonsense. I’ve no idea what would happen, and I think it’s foolish to spend time arguing about hypotheticals.

Nevertheless, this issue has seen sharp battle lines drawn over the past few years. Proponents of repealing the tax make it out to be the most obvious thing in the world, and a shibboleth for determining who is truly conservative. Opponents say it’s not that simple.

So what are the pros and cons of eliminating the sales tax on groceries?

In 2023, my family of seven paid $6,418 for groceries. That means we paid $385 in sales tax, but received $790 back via the grocery tax credit. It’s a good deal for me, but should other taxpayers really be subsidizing my family’s food purchases?

To break even, my family would need to spend $14,000 on groceries each year — that’s nearly $1,200 per month.

Redistributing wealth to lower income people is typically a progressive idea, not a conservative one.

However, conservatives have a point when they say the eliminating the tax and the credit would put more money in people’s pockets now. In the case of my family, we would have kept $385 last year, at the cost of the $790 we received after filing our taxes. That’s a few more pounds of cheap ground beef, at least.

Conservatives tend to oppose laundering money through government offices, which the grocery sales tax essentially does. You pay an extra 6% at the cash register, which then winds its way through the bureaucracy before coming back to you when you file your taxes the following year. Some families (like mine) get more than they paid, while others get less. Is that fair and right?

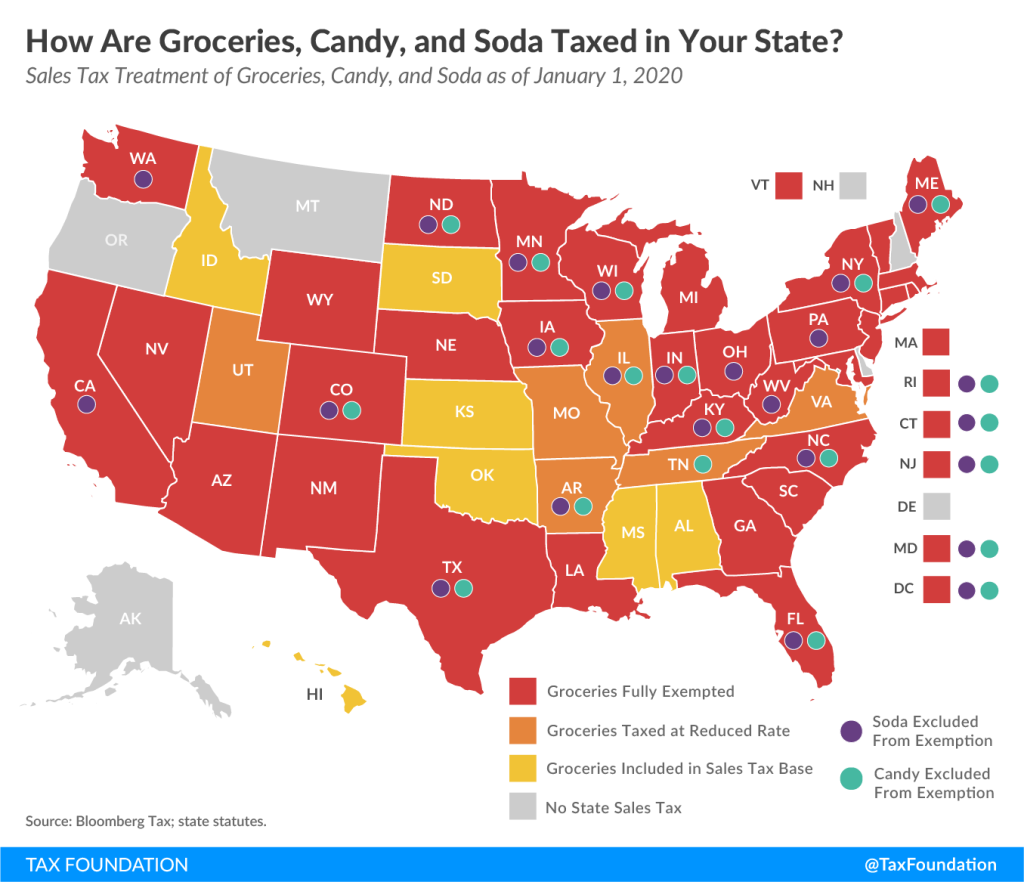

My former home state of Washington exempted groceries from sales taxes, but the state’s definition of grocery was very subjective. Soda was not exempt from taxation, while other drinks were. Prepared foods at restaurants or even in-store delis were not exempt either. Is Idaho prepared to have legislators or bureaucrats decide what counts as groceries and are therefore exempt from sales tax?

One point often brought up by opponents of a grocery tax repeal is that out-of-state travelers contribute to our state by paying taxes on food but do not receive the tax credit.

Proponents of repeal say that taxing people on basic necessities such as groceries is immoral, whether they live in Idaho or not.

For libertarians who believe all taxation is theft, the grocery tax seems a low hanging fruit that should be easy to lop off. On the other hand, if we must have some of taxation, then we need a serious debate about what form it should take. What is the “least immoral” tax? Progressives believe that taxes should be, well, progressive, more heavily weighted toward those with more money. Federal income taxes are progressive, with the lowest earners paying 10% (and qualifying for many credits and refunds) while the highest earners pay 37% at the top bracket.

Sales taxes are generally flat, because a poor person and a millionaire still pay the same 6% for a loaf of bread. Conservatives have long supported flat or fair taxes, since progressive taxation is a form of wealth redistribution. Government economists say that sales taxes are the most stable form of taxation as well. Finally, consumers have more control over how much sales tax they pay, at least once basic needs such as groceries are met.

Property taxes are perhaps the most immoral form of taxation, since they apply to what you own, not what you earn or what you buy. A family can pay off their mortgage yet still owe yearly rent to the government in the form of property taxes. However, since this funds local taxing districts such as schools, libraries, and cities, it’s a harder nut for the Legislature to crack. Last year’s House Bill 292 brought some property tax relief to homeowners, partly through redirecting some sales tax revenue.

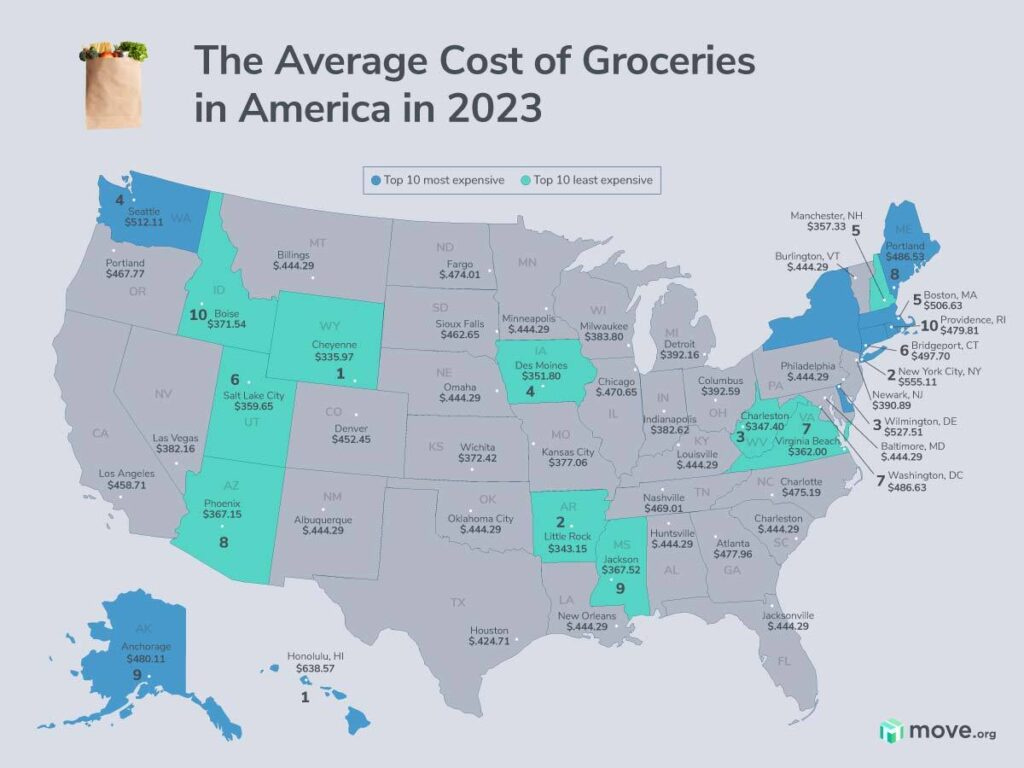

Some suggest that Idaho’s sales tax on food negatively impacts local businesses in border towns. I don’t know how often residents of Lewiston, Coeur d’Alene, or Fruitland cross the border to buy groceries, or whether or not the out-of-state stores have higher prices to compensate. According to move.org, the average cost of food in Idaho is $371.54 per person, much lower than Washington, Oregon, and Montana, but slightly higher than Utah and Wyoming.

Personally, I’m divided on the issue. I see pros and cons. What do you think? Should Idaho exempt groceries from sales taxes? Should this be our top priority in the next legislative session? Did I miss any arguments on either side? Is this the white whale that we must harpoon at all costs, or is it a red herring leading us on a wild goose chase?

Join the conversation in the comments or on Twitter, or send me a letter to the editor and I’ll post it this Wednesday.

Gem State Chronicle is a reader-supported publication. Not subscribed? As a free subscriber to the Gem State Chronicle you receive daily articles in your inbox. Paid subscribers get bonus notes, early access, and exclusive content. Click here to subscribe today!

About Brian Almon

Brian Almon is the Editor of the Gem State Chronicle. He also serves as Chairman of the District 14 Republican Party and is a trustee of the Eagle Public Library Board. He lives with his wife and five children in Eagle.