In my last job before moving to Idaho, I worked as a network administrator for World Vision USA. It is the sister organization to World Vision International, a Christian nonprofit founded by missionary Bob Pierce in 1950. Originally meant to support war orphans in Korea, World Vision eventually expanded throughout the world. Donors, many in the United States, “sponsor” a child in a faraway country, with the money being used for schools, clean water, medical care, and other necessities.

Pierce left World Vision in 1967, having apparently grown disillusioned with the organization’s direction. He founded Samaritan’s Purse in 1970, seemingly to be what World Vision had been in the beginning. Franklin Graham took over the organization shortly before Pierce’s death and still serves as its president to this day.

One thing I found concerning while I worked there was how important government grants had become to the organization’s operations. Individual sponsorships were still heavily promoted, but tax dollars provided a large share of World Vision’s operating revenue. According to website MinistryWatch, World Vision USA took in more than $660 million in government grants in 2023—43.8% of its $1.5 billion in revenue that year.

This is not necessarily meant to slag my old employer. It was a reasonably positive place to work, and I think its heart is in the right place. Yet there is something unsettling about the way private charity has been transformed over the past half century. Charitable organizations and philanthropic foundations were once focused on direct aid to the needy. Donations were freely given by people out of their own generosity, knowing they would directly help their neighbors. This is why the nonprofit classification was created in the first place: to incentivize giving to organizations that directly helped people in need.

Yet a double transformation has taken place. First, governments began making grants available to nonprofit charities. It became easier to fund operations by applying for grants than by raising large numbers of small-dollar donations. The second transformation was the shift by many nonprofits from direct aid to indirect action, such as lobbying governments for political change. These lobbying efforts are often aimed at increasing government funding for programs—including the organizations themselves.

Today, there are countless nonprofits that not only survive off the taxpayer, but use that money to lobby the government, often in ways that are detrimental to the very citizens funding their operations. Remember the Jannus hydra? An affiliation of organizations, each with its own branding, lobbies government to increase funding for its own operations, which already include tens of millions of dollars from the American taxpayer.

So how independent is ICFP, which just released a report lamenting that the government “allowed” citizens to keep too much of their own money? Not very. It is one small part of a massive web of NGOs and nonprofits, all designed to convince the government to take more of your money and give it to them for their own purposes. While the mythical Janus had two faces, the modern Jannus is akin to the hydra, which had many.

One head of this hydra issues reports like this, claiming that we need higher taxes to support more government spending on social programs. Another head lobbies the Legislature to create more of these social programs and to appropriate more money—federal and state—to them. Finally, yet another head stands ready to apply for these new grants and distribute them as they see fit. Oftentimes, the purpose of the grants is to incorporate more people into government dependence. Refugees, for example—the primary focus of Jannus now—are brought here and immediately enrolled in myriad taxpayer-supported programs, all with Jannus acting as the middleman.

All of this came to mind when I read an article in Idaho Ed News this morning about the cancellation of government grants for the Community Schools Program in Idaho. In 2023, the U.S. Department of Education awarded $45.9 million over five years, with funds distributed through the United Way of the Treasure Valley. According to reporter Sean Dolan, this money currently funds 60 full-time staff members in 47 different schools. The job of these staff members is to “connect families with local resources.”

The Trump administration has canceled the grant, saying it prioritizes DEI over “merit, fairness, and excellence in education.” Those invested in the grant reacted sharply. From the article:

“We’re gonna fight like hell so it doesn’t happen,” Roghaar said.

Laura Roghaar works for United Way of Treasure Valley as project manager for the program funded by this grant.

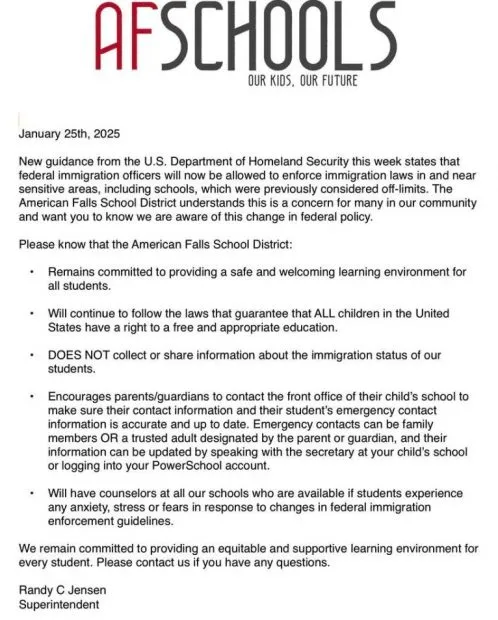

“These are things that the governor believes in and wants, and so I’m just hoping some of our state leaders really step in and try to help us out here in the appeal,” Jensen said.

Randy Jensen is superintendent of American Falls School District.

In the Moscow School District, community schools coordinator Brian Smith said losing the grant funding will leave them “gutted.”

Staff members at the United Way of Idaho were devastated when they received the notice of discontinuation on Friday, said marketing and communications specialist Lukas Robertson.

In addition to employing 60 people, the grant funded free clothing, books, supplies, after-school programs, and free lunches in the summertime. Is it necessary that government fund these things? Are there no private charities that could handle needs like this within their own communities?

Highlighting this story on X, Brandy Paradee pointed out pointed out that American Falls superintendent Randy Jensen—quoted in the story lamenting the potential loss of grant money—responded to federal immigration enforcement very differently just last January:

It makes one wonder how many illegal aliens are enrolled in American Falls schools. It also makes one wonder how many noncitizens are taking advantage of resources provided by federal grants.

The scope and scale of how our tax dollars are redistributed through NGOs and nonprofits is staggering. Consider how many people live off programs like this, whether as direct beneficiaries or as employees of organizations that depend on tax dollars for revenue. Take United Way of the Treasure Valley, for example, the organization tasked with managing millions of dollars for these community schools programs. According to a 2025 audit, more than half of the organization’s revenue comes from government grants, while nearly a third of total revenue is used for employee salaries, benefits, travel, and related expenses.

I get it. Nonprofits have to pay employees too, no matter how much good they might be doing in the community. Yet we have reached a point where tax dollars—either directly confiscated from citizens or indirectly extracted through the hidden tax of inflation—are being used in place of private charity. I have taken some flak for presenting arguments in favor of keeping property taxes, for example, but those are imposed by local governments to pay for local projects. The trustees who set budgets based on those taxes must answer to the voters. I do not remember voting to give $45.9 million to United Way to fund “community schools coordinators” whose job is to “organize resources that already exist in the community and bring them into the school, where they can be accessed by kids and families.” Do you?

Nobody voted for USAID. Nobody voted to create an entire ecosystem of quasi-governmental agencies that use our tax dollars to reshape our society. Yet here we are.

Even if we had voted for it, there is a limit to the proper scope and role of government. Taxing citizens to pay for roads and law enforcement is one thing; taxing us to fund nonprofits that usurp the role of private charities is quite another. I applaud the Department of Education for ending this grant. I am sorry for those who may lose their jobs, but those positions should never have existed in the first place. Returning to a system of private charity and limited government will not be painless, but it is necessary.

Gem State Chronicle is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

About Brian Almon

Brian Almon is the Editor of the Gem State Chronicle. He also serves as Chairman of the District 14 Republican Party and is a trustee of the Eagle Public Library Board. He lives with his wife and five children in Eagle.