Nobody likes property taxes. They make every homeowner a permanent renter of the government, while assessing homes based on current market value rather than the price originally paid. Yet for now, property taxes remain the primary method of funding local government services.

A few weeks ago, I suggested attending budget hearings held by your local taxing districts and sharing your concerns with the elected officials responsible for those budgets. But there’s an additional wrinkle when it comes to deciding how your tax dollars are spent: even though property taxes are levied by local districts, many of the services those districts provide are mandated by the Idaho Legislature.

Late last year, the Ada County Board of Commissioners commissioned a study to identify which county functions are required by state law. The result was a 47-page document that catalogs every statutory obligation placed on the county. You can read that document here:

With the help of ChatGPT, I’ve summarized the biggest and most expensive state mandates and cross-referenced them with Ada County’s FY2025 budget. Here is a small sample of those mandates:

Public Safety (approx. $182M / 46.5% of total budget)

- County Jail operations (Idaho Code Title 20, Chapter 6): Housing pretrial detainees, convicted inmates, and providing medical care, food, and security.

- Sheriff duties (Idaho Code Title 31, Chapter 22): Enforcing laws, serving court orders, operating dispatch, attending court, and managing civil processes such as evictions and garnishments.

- Emergency services & search/rescue (Idaho Code § 31-2229): Mandated emergency response and search operations.

- Sex offender registration & tracking (Idaho Code § 18-8307): Quarterly or monthly check-ins, address verification, and database maintenance.

Judicial System Support (approx. $50.8M / 13.0% of total budget)

- District & Magistrate Courts (Idaho Code § 1-1613): Providing courthouses, staff, technology, and courtroom security.

- Jury administration (Idaho Code Title 2, Chapter 2): Maintaining lists, paying jurors, and managing the Jury Commission.

- Prosecuting Attorney’s Office (Idaho Code § 31-2604): Criminal and civil prosecution, legal counsel to county offices.

- Public Defender Support (Idaho Code Title 31 Chapter 46): Providing office space free of charge to the state Public Defender through 2029.

General Government Administration (approx. $112.6M / 28.8% of total budget)

- Elections administration (Idaho Code § 34-305): Clerks must run all local, state, and federal elections while maintaining accuracy and security.

- Property assessment & tax collection (Idaho Code Title 31, Chapter 21): Assessor and Treasurer roles in appraising property and collecting taxes.

- Budgeting, auditing, and financial compliance (Idaho Code Title 31, Chapters 16 and 17): State-mandated procedures for accounting, publishing budgets, and financial audits.

- Legal notices (Idaho Code Title 60, Chapter 1): Counties must publish ordinances and financial summaries in newspapers—at taxpayer expense.

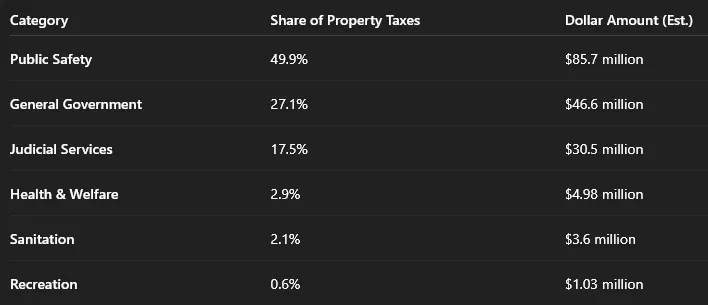

This is just a few of the hundreds the mandates with which counties such as Ada must comply. These three categories—public safety, judicial services, and general government—account for nearly 90% of Ada County’s total budget. By contrast, areas like recreation and sanitation make up just 2.7%, with much of that funded by user fees rather than property taxes.

For FY2025, Ada County expects to collect $171.7 million in property taxes. The vast majority of that revenue will go toward fulfilling these state-imposed duties, not toward discretionary projects or pet initiatives.

This puts county commissioners in a bind: constituents want lower taxes, but the county is legally obligated to provide services that cost money—and that obligation comes from Boise. Most of these mandates are unfunded by the state, meaning it’s up to the counties to raise enough revenue to fulfill their statutory duties.

Commissioner Ryan Davidson recently explained the situation to Carolyn Komatsoulis at the Idaho Statesman. At a recent county budget hearing, Davidson said:

“This is as much going to be a testimony to the Legislature,” Davidson said during budget hearings in mid-June. “Just exactly how many of our duties and responsibilities are chosen for us, not by us, but by the state Legislature.”

Fellow commissioner Tom Dayley, who has served in both the Idaho Legislature and the federal government, reinforced that point:

Part of the idea of listing Ada County’s requirements is to show people who want cuts that they may not be possible, Commissioner Tom Dayley told the Idaho Statesman by phone. He said he appreciated the federal government’s focus on efficiency, but Ada County has operated on the DOGE ethos for years.

As you can see, while the Legislature doesn’t levy property taxes directly, it does pass laws that require counties and other districts to perform—and pay for—specific functions. Bringing property taxes under control will require more than attending budget hearings; it means working with your legislators to ensure that these mandates reflect the priorities and values of Idaho citizens as well as the proper role and scope of local government.

Before anything can be changed, it must first be measured. I commend Commissioners Davidson, Dayley, and Rod Beck for their effort to document and publish this information. Citizenship in a Republic means taking the time to understand how things work and then doing our part to make them better.

Gem State Chronicle is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

About Brian Almon

Brian Almon is the Editor of the Gem State Chronicle. He also serves as Chairman of the District 14 Republican Party and is a trustee of the Eagle Public Library Board. He lives with his wife and five children in Eagle.