Nobody likes property taxes, but many people appreciate the things they pay for. Public schools, municipal infrastructure, parks, law enforcement, and more are funded by taxes levied on real property. These taxes are assessed by elected representatives, who are required to publish their budgets and take public input before increasing them. Nevertheless, there is something deeply immoral about a system that taxes you on the unrealized value of your home.

Most other taxes are based on activity, such as buying goods and services, earning an income, running a business, or transacting in the stock market. Property taxes, by contrast, are levied on something you own, the value of which often fluctuates beyond your control. If you bought your home for $100,000 twenty-five years ago but it’s now worth $1 million, you’re taxed on today’s market price, not what you paid for it.

Idaho has one of the lowest property tax burdens in the nation, but that’s little comfort to people who worked hard to pay off their mortgages only to be handed an annual bill—you’re essentially permanently renting from the government. There are programs like the homeowner’s exemption and the circuit breaker that help some residents stay in their homes, but they don’t address the principle at stake.

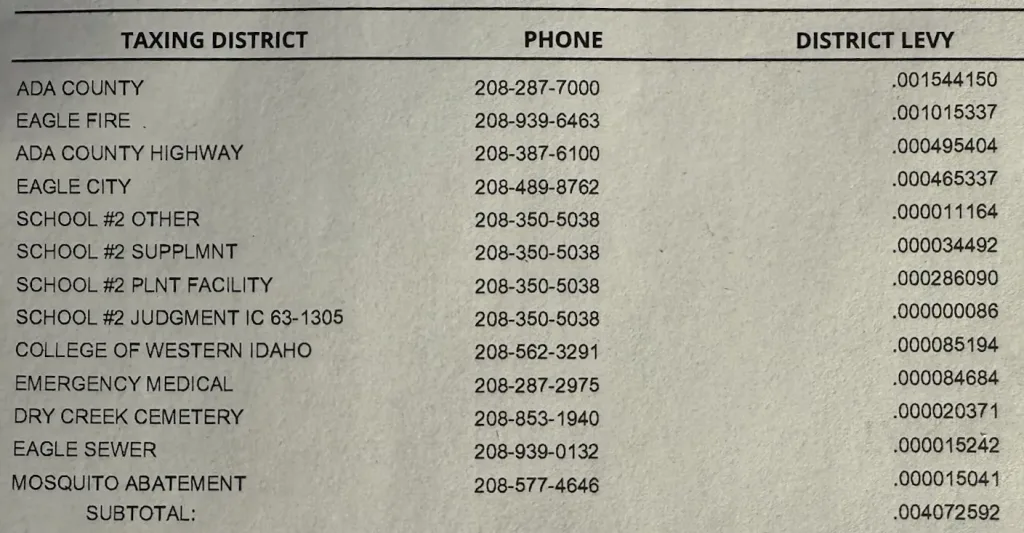

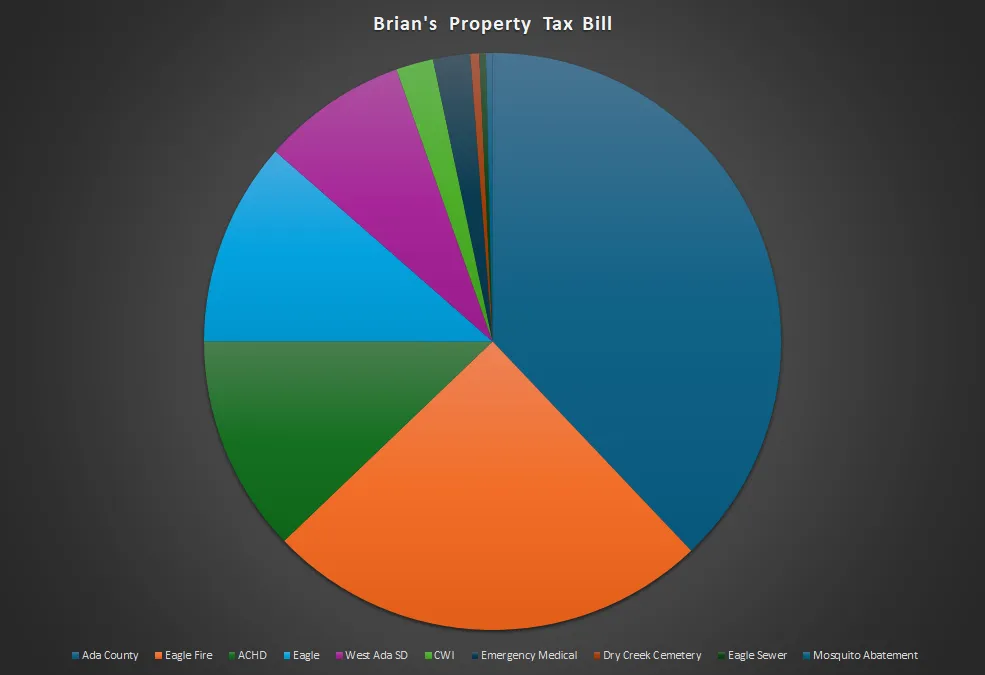

Property taxes are calculated by totaling the budgeted needs of all the taxing districts in a given area and dividing that by the total taxable value of property within the district. The resulting figure is called the levy rate. Your property tax bill is determined by multiplying the levy rate by your assessed property value, minus any exemptions. Since each property typically belongs to multiple taxing districts, your final bill reflects the combined rates.

For example, my own property tax bill lists about ten separate taxing districts, each with its own levy rate:

As you can see, Ada County takes the lion’s share of my property taxes at nearly 38%, with a lot of that going to pay for county law enforcement. Eagle Fire District is next at 25%, while Ada County Highway District takes just over 12%. The City of Eagle takes around 11.5%, which is on the low end of Treasure Valley cities, while West Ada School District extracts just over 8% of my total tax bill across four levies.

About 4.7% of my total tax bill was deducted due to 2023’s House Bill 292.

In all, I paid just over $1,600 in property taxes for the year 2024. Compared to my former home state of Washington, where my last tax bill exceeded $4,000 for a place half the size of our current home, that’s a bargain. But is there a better way?

While sales and income taxes in Idaho are imposed by the Legislature and fund state and some local services, property taxes are levied by local governments. The Legislature has made various adjustments to the system, such as capping annual increases at 3%, and diverting general fund surpluses for property tax relief, but abolishing property taxes entirely would be a major challenge.

Why? Because someone has to fund local government services. According to the Idaho State Tax Commission’s most recent report, Idahoans paid more than $2.16 billion in property taxes in 2023. If we could simply snap our fingers and eliminate those taxes, what would local taxing districts do to fill the gap? The libertarian answer is, of course, to simply cut everything, but that’s not what most voters want.

Nearly a year ago, I wrote that it’s ultimately up to voters to decide what they want cities and other local entities to pay for:

Ultimately, it is the citizens who are responsible for making these decisions. We elect mayors and council members to act on our behalf, agreeing to pay a certain amount in property taxes to support their endeavors. If they overstep or mismanage the funds we’ve entrusted to them, it is our duty to vote them out of office and replace them with people who better align with our values.

First, however, we must articulate those values. What do we want from our city and county governments? How many police officers are necessary to maintain public safety? Should the city operate public parks for picnics, playgrounds, and other recreational activities? Should it fund youth sports? What about civic and community centers, public libraries, and services for seniors? What about emergency medical services?

Should cities subsidize professional sports stadiums? What about offering tax breaks to attract certain businesses? Both approaches aim to create jobs and draw customers for local businesses, and municipalities that don’t offer such incentives risk losing out to those that do. Are these practices justified?

Assuming, for the sake of argument, we agree that some revenue should go to local districts, how could we eliminate property taxes while still funding essential services?

One option would be to take House Bill 292 to its logical conclusion and shift all local funding to income and sales taxes. The problem with that approach is accountability. Right now, local boards must face voters directly, and those voters can approve or reject bonds and levies as well as replace board members who raise taxes irresponsibly. Shifting funding to the state severs that direct line of accountability. Could we really expect the Legislature to fairly decide whether Melba or Meridian is more deserving of limited general fund dollars?

What about allowing local sales taxes? Right now, Idaho has a uniform 6% sales tax across the state, with local governments prohibited from adding their own surtaxes. In contrast, other states like Washington allow local sales tax rates to vary. My purchases there were taxed at 6%, 8%, 10%, or even higher, depending on which city or county I happened to be shopping in at the time.

Of course, conservatives oppose tax increases as a rule. So what’s the path forward?

Perhaps Florida is showing the way, where Gov. Ron DeSantis has proposed eliminating property taxes entirely. He explained the moral impetus on a recent podcast appearance:

Do you ever own your own home? …you have to continue writing a check to the government, every year, just for the privilege of being able to use property that you supposedly already own.

Cliff Maloney, CEO of Citizens Alliance, praised the initiative in an op-ed at RedState:

If Texas and Florida lead the way on this, other red states will absolutely follow in their footsteps, I guarantee it.

Abolishing property taxes shifts that balance of power back where it belongs—to the individual. It forces governments to be leaner, more accountable, and more respectful of personal property.

It restores the idea that what you earn and build is yours, not subject to forfeiture because of bloated spending agendas.

Some Florida Republicans have pushed back on DeSantis’ plan:

Rep. Dean Black, a Jacksonville Republican and former Duval County GOP chair, called property taxes “a profound and indispensable source of revenue” for financing police and fire protection. He even worried that some communities might respond by “defunding” law enforcement.

…while others agree with the governor:

“They are taking that extra money, they’re not even being anywhere near frugal with the money. They’re just expanding government,” [Sen. Blaise] Ingoglia said.

If Florida were to eliminate property taxes, it would be the first state in the nation to do so. Property tax laws have existed for centuries. Idaho allowed local governments to tax property even before statehood in 1890, and the legality of property taxes was enshrined in our original constitution. That doesn’t mean we shouldn’t try to eliminate them, but we must recognize the deep roots we’d have to dig up to make it happen.

Property taxes present a genuine conundrum. I believe they are the least moral form of taxation, yet paradoxically they are the most accountable. The fact that few people turn out for off-year elections or attend budget hearings doesn’t change the reality that property taxes are more responsive to public pressure than income or sales taxes. Nevertheless, the very existence of property taxes is an infringement upon the right to property, one of the oldest and most sacred rights in Western tradition.

What do you think? Should property taxes be abolished? If so, what should cities, counties, and special districts do for revenue?

Gem State Chronicle is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

About Brian Almon

Brian Almon is the Editor of the Gem State Chronicle. He also serves as Chairman of the District 14 Republican Party and is a trustee of the Eagle Public Library Board. He lives with his wife and five children in Eagle.